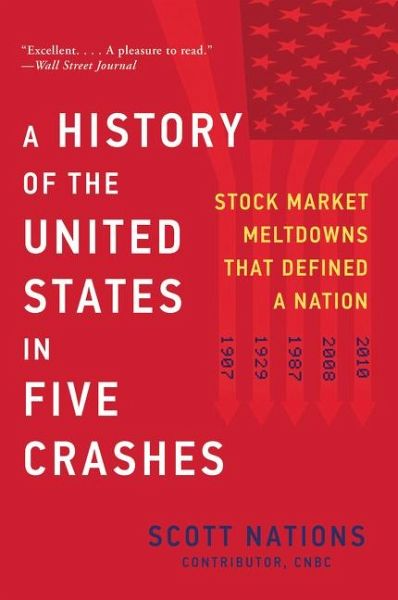

A History of the United States in Five Crashes

Stock Market Meltdowns That Defined a Nation

PAYBACK Punkte

8 °P sammeln!

In this compelling, smart, and accessible blend of economic and cultural history, Scott Nations, a longtime trader, financial engineer, and CNBC contributor, takes us on a journey through the five significant stock market crashes of the last century and how they defined today’s America. The names have entered into lore: The Panic of 1907. Black Tuesday and Black Monday. The Great Recession. The Flash Crash. In this perceptive book, Nations reveals the common threads that have underpinned these economic crises. Many were the unintended consequence of a new financial contraption, such as “po...

In this compelling, smart, and accessible blend of economic and cultural history, Scott Nations, a longtime trader, financial engineer, and CNBC contributor, takes us on a journey through the five significant stock market crashes of the last century and how they defined today’s America. The names have entered into lore: The Panic of 1907. Black Tuesday and Black Monday. The Great Recession. The Flash Crash. In this perceptive book, Nations reveals the common threads that have underpinned these economic crises. Many were the unintended consequence of a new financial contraption, such as “portfolio insurance” in 1987 or those infamous mortgage-backed securities in 2008. Sometimes a well-intentioned government intervention, like the newly created Federal Reserve’s meddling with interest rates in 1929, backfired spectacularly. And then, often, disaster was triggered by an event no one could have foreseen, like the San Francisco earthquake or the Greek riots of 2010. Nations expertly interprets the winding road to each failure and charts the paths toward recovery, from J. P. Morgan’s near-single-handed rescue of American stocks in 1907 to the $700 billion bailout that was required to stabilize the economy in 2008. A captivating read for both veteran investors and those just looking to better understand our financial system, A History of the United States in Five Crashes shows what we have learned from a century of economic history—and how we can use these lessons to prevent the next crash.