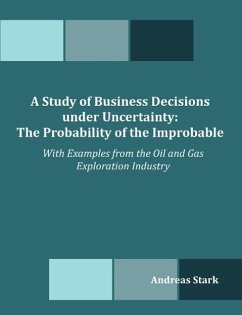

A Study of Business Decisions under Uncertainty

The Probability of the Improbable - With Examples from the Oil and Gas Exploration Industry

Versandkostenfrei!

Versandfertig in 1-2 Wochen

32,99 €

inkl. MwSt.

PAYBACK Punkte

16 °P sammeln!

This dissertation will discuss the uncertainty encountered in the daily operations of businesses. The concepts will be developed by first giving an overview of probability and statistics as used in our everyday activities, such as the basic principles of probability, univariate and multivariate statistics, data clustering and mapping, as well as time sequence and spectral analysis. The examples used will be from the oil and gas exploration industry because the risks taken in this industry are normally quite large and are ideal for showing the application of the various techniques for minimizin...

This dissertation will discuss the uncertainty encountered in the daily operations of businesses. The concepts will be developed by first giving an overview of probability and statistics as used in our everyday activities, such as the basic principles of probability, univariate and multivariate statistics, data clustering and mapping, as well as time sequence and spectral analysis. The examples used will be from the oil and gas exploration industry because the risks taken in this industry are normally quite large and are ideal for showing the application of the various techniques for minimizing risk. Subsequently, the discussion will deal with basic risk analysis, spatial and time variations of risk, geotechnical risk analysis, risk aversion and how it is affected by personal biases, and how to use portfolios to hedge risk together with the application of real options. Next, fractal analysis and its application to economics and risk analysis will be examined, followed by some examples showing the change in the Value at Risk under Fractal Brownian Motions. Finally, a neural network application is shown whereby some of these risks and risk factors will be combined to forecast the best possible outcome given a certain knowledge base. The chapters will discuss: ¿ Basic probability techniques and uncertainty principles ¿ Analysis and diversification for exploration projects ¿ The value and risk of information in the decision process ¿ Simulation techniques and modeling of uncertainty ¿ Project valuation and project risk return ¿ Modeling risk propensity or preference analysis of exploration projects ¿ Application of fractals to risk analysis ¿ Simultaneous prediction of strategic risk and decision attributes using multivariate statistics and neural networks