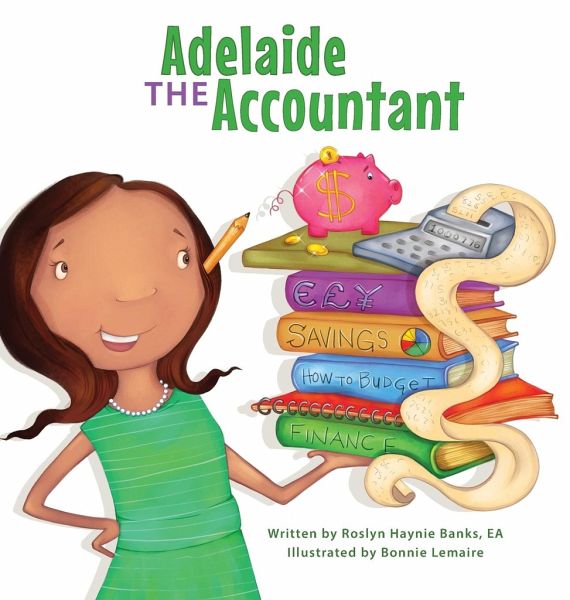

Adelaide the Accountant

Versandkostenfrei!

Versandfertig in 1-2 Wochen

23,99 €

inkl. MwSt.

PAYBACK Punkte

12 °P sammeln!

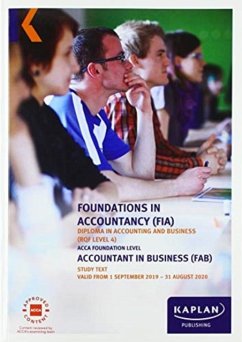

Follow a week in the life of a tax accountant to see which community helpers in science, technology, engineering, arts, and math careers earn and spend tax dollars! Roslyn's goal for this book is to help children and adults understand that the tax system works best when we all pay our fair share. "Taxes are very important. We all need to pay our fair share so that we all can succeed!" We hope is that this book sows seeds of financial literacy and a sense of community in each reader! It is designed for readers of all ages to be read over and over again as you grow and become more advanced with ...

Follow a week in the life of a tax accountant to see which community helpers in science, technology, engineering, arts, and math careers earn and spend tax dollars! Roslyn's goal for this book is to help children and adults understand that the tax system works best when we all pay our fair share. "Taxes are very important. We all need to pay our fair share so that we all can succeed!" We hope is that this book sows seeds of financial literacy and a sense of community in each reader! It is designed for readers of all ages to be read over and over again as you grow and become more advanced with money and financial literacy concepts. Wealth includes assets that are tangible and intangible, such as money, property, family values, work ethics and a good reputation. This book is designed to provide readers with a general overview of a week in the life of an income tax practitioner and an introduction to accounting principles. It is not designed to be a definitive investment guide or to take the place of financial, tax or legal advice. Income tax laws are subject to change proactively or retroactively.