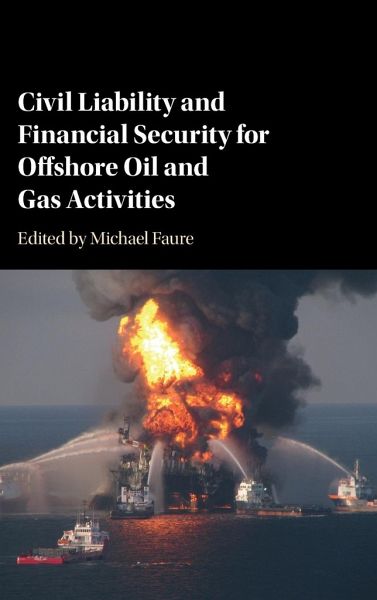

Civil Liability and Financial Security for Offshore Oil and Gas Activities

Versandkostenfrei!

Versandfertig in 1-2 Wochen

146,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

73 °P sammeln!

Civil Liability and Financial Security for Offshore Oil and Gas Activities provides insights into the liability and compensation regime for offshore-related damage. The book analyses the legal regime in a variety of states (including the US and the UK) as well as the EU regime. In addition, the various compensation mechanisms and amounts available today to compensate offshore-related damage are described and critically analysed. Moreover, the book is based on in-depth interviews with a wide variety of relevant stakeholders including insurers, representatives from supervisory authorities, and o...

Civil Liability and Financial Security for Offshore Oil and Gas Activities provides insights into the liability and compensation regime for offshore-related damage. The book analyses the legal regime in a variety of states (including the US and the UK) as well as the EU regime. In addition, the various compensation mechanisms and amounts available today to compensate offshore-related damage are described and critically analysed. Moreover, the book is based on in-depth interviews with a wide variety of relevant stakeholders including insurers, representatives from supervisory authorities, and oil and gas producers. This volume also provides a variety of policy recommendations, formulated to provide an optimal compensation regime for offshore-related damage.