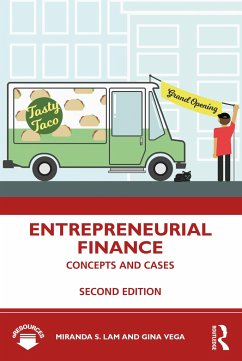

Entrepreneurial Financial Management

An Applied Approach

Versandkostenfrei!

Versandfertig in über 4 Wochen

94,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

47 °P sammeln!

This fifth edition of a classic and comprehensive resource presents an applied, realistic view of entrepreneurial finance for todayâ s entrepreneurs, completely updated to address the latest trends and technologies.