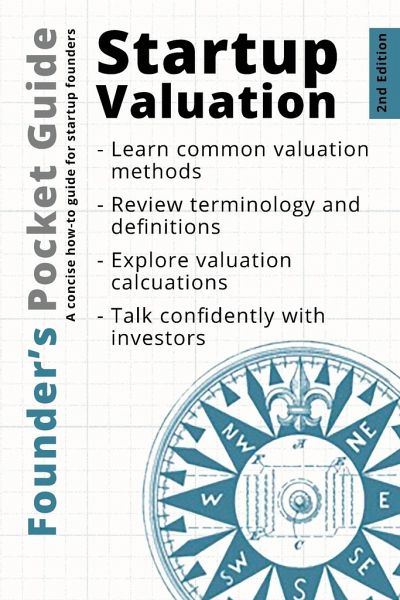

Founder's Pocket Guide

Startup Valuation

Versandkostenfrei!

Versandfertig in 1-2 Wochen

10,99 €

inkl. MwSt.

PAYBACK Punkte

5 °P sammeln!

This guide is designed to be an introduction and quick reference to early-stage startup valuation topics. For many early-stage entrepreneurs assigning a pre-money valuation to your startup is one of the more daunting tasks encountered during the fundraising quest. This guide reviews all of the key topics around early-stage startup valuation and provides step-by-step examples for several valuation methods. In more detail, this Founder’s Pocket Guide helps startup founders learn: • What a startup valuation is and when you need to start worrying about it. • Key terms and definitions associa...

This guide is designed to be an introduction and quick reference to early-stage startup valuation topics. For many early-stage entrepreneurs assigning a pre-money valuation to your startup is one of the more daunting tasks encountered during the fundraising quest. This guide reviews all of the key topics around early-stage startup valuation and provides step-by-step examples for several valuation methods. In more detail, this Founder’s Pocket Guide helps startup founders learn: • What a startup valuation is and when you need to start worrying about it. • Key terms and definitions associated with valuation, such as pre-money, post-money, and dilution. • How investors view the valuation task, and what their expectations are for early-stage companies. • How the valuation fits with your target raise amount and resulting founder equity ownership. • How to do the simple math for calculating valuation percentages. • How to estimate your company valuation using several accepted methods. • What accounting valuation methods are and why they are not well suited for early-stage startups.