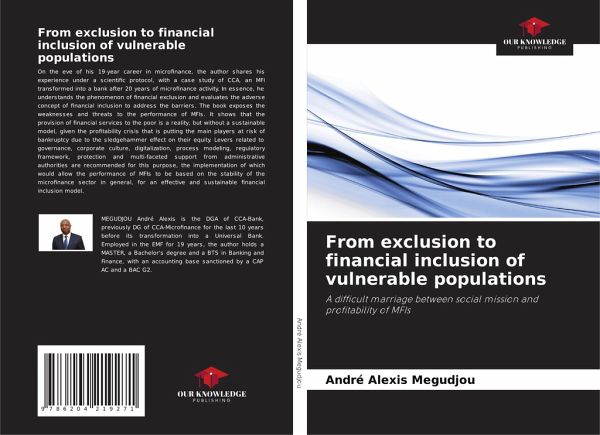

From exclusion to financial inclusion of vulnerable populations

A difficult marriage between social mission and profitability of MFIs

Versandkostenfrei!

Versandfertig in 6-10 Tagen

31,99 €

inkl. MwSt.

PAYBACK Punkte

16 °P sammeln!

On the eve of his 19-year career in microfinance, the author shares his experience under a scientific protocol, with a case study of CCA, an MFI transformed into a bank after 20 years of microfinance activity. In essence, he understands the phenomenon of financial exclusion and evaluates the adverse concept of financial inclusion to address the barriers. The book exposes the weaknesses and threats to the performance of MFIs. It shows that the provision of financial services to the poor is a reality, but without a sustainable model, given the profitability crisis that is putting the main player...

On the eve of his 19-year career in microfinance, the author shares his experience under a scientific protocol, with a case study of CCA, an MFI transformed into a bank after 20 years of microfinance activity. In essence, he understands the phenomenon of financial exclusion and evaluates the adverse concept of financial inclusion to address the barriers. The book exposes the weaknesses and threats to the performance of MFIs. It shows that the provision of financial services to the poor is a reality, but without a sustainable model, given the profitability crisis that is putting the main players at risk of bankruptcy due to the sledgehammer effect on their equity. Levers related to governance, corporate culture, digitalization, process modeling, regulatory framework, protection and multi-faceted support from administrative authorities are recommended for this purpose, the implementation of which would allow the performance of MFIs to be based on the stability of the microfinance sector in general, for an effective and sustainable financial inclusion model.