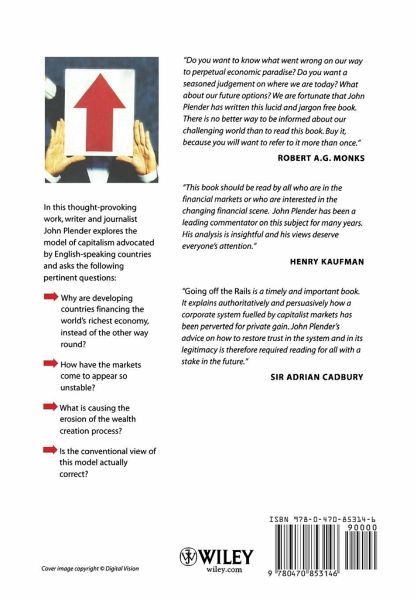

Going Off the Rails

Global Capital and the Crisis of Legitimacy

PAYBACK Punkte

22 °P sammeln!

The capitalist model was developed in the 19th century and recent events have shown the difficulties of adapting this to the demands of the 21st century, in which human and social capital are of far greater importance than physical capital. In Going off the Rails, John Plender shows how corporate scandals, inflated boardroom pay, corporate governance disciplines and outmoded accountancy conventions have stretched the Anglo-American model to its limit and what the effects of this might be on globalisation and the capital markets.