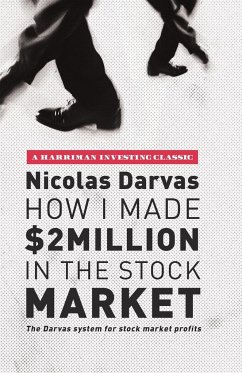

Nicolas Darvas

Broschiertes Buch

How I Made $2 Million in the Stock Market

The Darvas System for Stock Market Profits

Versandkostenfrei!

Versandfertig in 1-2 Wochen

PAYBACK Punkte

9 °P sammeln!

Tells one of the most unusual success stories in the history of the stock market.

Nicolas Darvas was a celebrated private investor of the 1960s. His colourful lifestyle, coupled with his highly successful investing methods, attracted national attention and earned him a feature in Time magazine.

Produktdetails

- Verlag: Harriman House Publishing

- Seitenzahl: 188

- Erscheinungstermin: 9. Juni 2015

- Englisch

- Abmessung: 216mm x 140mm x 11mm

- Gewicht: 252g

- ISBN-13: 9780857194503

- ISBN-10: 085719450X

- Artikelnr.: 41478229

Herstellerkennzeichnung

Libri GmbH

Europaallee 1

36244 Bad Hersfeld

gpsr@libri.de

Für dieses Produkt wurde noch keine Bewertung abgegeben. Wir würden uns sehr freuen, wenn du die erste Bewertung schreibst!

Eine Bewertung schreiben

Eine Bewertung schreiben

Andere Kunden interessierten sich für