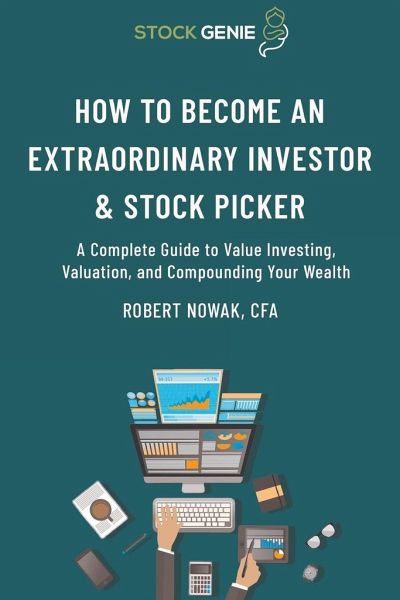

How to Become an Extraordinary Investor and Stock Picker

A Complete Guide to Value Investing, Valuation, and Compounding Your Wealth

Versandkostenfrei!

Versandfertig in 1-2 Wochen

20,99 €

inkl. MwSt.

PAYBACK Punkte

10 °P sammeln!

This book will serve as your foundation to become the best investor you can be. The time-tested principles of the value investing process and philosophy are discussed to convince you why it works. You'll realize that once you treat investing as a discipline, you'll get better results over the long-term. I tried to blend both the quantitative and qualitative aspects of investing. In this way, you'll get some philosophy as well as some real-world examples of where to search for and how to screen for stocks, as well as how to value them. Learn about what factors make certain stocks high-quality a...

This book will serve as your foundation to become the best investor you can be. The time-tested principles of the value investing process and philosophy are discussed to convince you why it works. You'll realize that once you treat investing as a discipline, you'll get better results over the long-term. I tried to blend both the quantitative and qualitative aspects of investing. In this way, you'll get some philosophy as well as some real-world examples of where to search for and how to screen for stocks, as well as how to value them. Learn about what factors make certain stocks high-quality and what makes them bargains. You'll be taught various metrics and ratios you can add to your toolbox of skills for analyzing a business. You'll learn about the magic of compounding returns over time and why it's important to start investing as soon as possible. You'll realize how to interpret a company's financial statements and the statistics to extract from them. Real-world case studies of valuing companies are presented and you'll master how to calculate the intrinsic value of any stock. Some questions answered in this book include: "What makes a superior business?" "How much should you pay for a quality stock?" "Why does value investing work over the long-run?" "Why does being a small investor give you an advantage?" "When should you sell a stock?" "How is risk different from uncertainty and volatility?" You'll become aware of all the elements you need to consider before investing in any company. A checklist approach to investing is presented along with why it's important. You'll learn about what aspects of a business you need to investigate before committing capital to it. Common investor biases also are discussed so that you'll be less likely to fall prey to them. I hope to convince you that the stock market isn't always efficient, and with patience you can outperform it. After reading this guide, you can be confident enough as an investor to start choosing investments and managing your own portfolio. By applying these value investing principles over time, you can compound your wealth and have fun along the way! Warmly, Robert Nowak, CFA