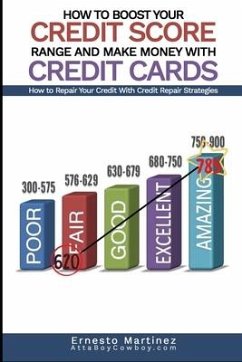

A low credit score can be very expensive and cause you to miss out on opportunities. If you need to increase your credit score to move into a new apartment, or house, buy a car, or get loans for business, this book will show you how to increase your credit score in hours!. This book has a complete game plan on how to get started and get the results you're looking for. In my case, I was trying to refinance my $300,000 mortgage. My credit score was 620 because I had some negative items on my credit that I wasn't aware of and extra debt on my credit cards that I could not afford to pay off. I was quoted an interest rate of 6.25% because of my low credit score. Instead of taking the loan, I repaired my credit by removing the incorrect items and paying down some of the debt on my credit cards. I waited a month, and my credit score jumped to 725. I reapplied for the loan and got a quote of 4.5%. If you have one mortgage, buy three cars over 30 years, and carry $10,000 credit card debt over the 30 years, you will spend an extra $238,500 on additional interest. Another way to look at it, you will throw away $238,500 to have the same things had you not maintained a healthy credit history and score. This book will teach you the fundamentals of; * Credit Repair * How the credit system works * How to maximize your credit benefits * Should College Students Have Credit Cards * Importance of Credit Scores * How to Improve Your Credit Score * The Difference between Credit and Debit Cards * Using Credit Cards for Investing * Advantages and Disadvantages of Credit Cards * Types of Credit Cards How to Boost Your Credit Score Range and Make Money With Credit Cards.: How to Repair Your Credit With Credit Repair Strategies can help you: * We recommend developing a monthly cash flow system that can generate thousands of dollars per month and use your credit cards to buy real assets like real estate. * This credit guide will teach you how to make money with your credit like a professional investor and help you build new income streams. Success is learnable; follow the strategies in this book, and open yourself to a new world of opportunities. " Dr. Ernesto Martinez offers a wealth of advice and information that any consumer would do well to follow and implement. I highly recommend this book for anyone interested in fixing their finances and generating new forms of income." Justin Degeneffe MBA, Credit Counselor