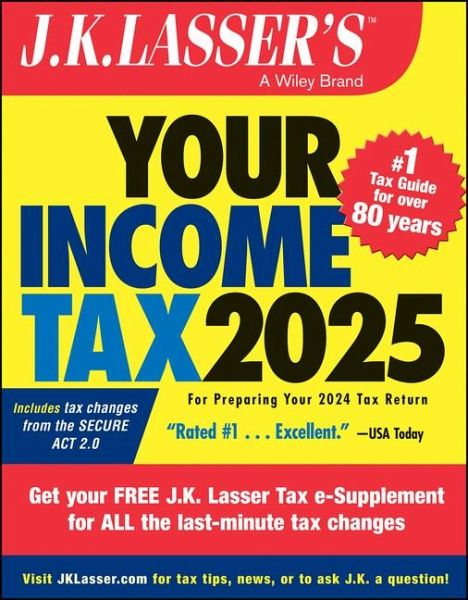

J.K. Lasser's Your Income Tax 2025

For Preparing Your 2024 Tax Return

Versandkostenfrei!

Versandfertig in 2-4 Wochen

27,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

14 °P sammeln!

The Most Trusted Name in Tax For over 80 years, more than 39 million Americans have trusted J.K. Lasser to help them save money at tax time J.K. Lasser can save you MORE money! Visit www.jklasser.com today for: * 365-day-a-year tax news, advice, and guidance * Free tax supplement Easy-to-Use Format Explains Complex Tax Laws * FILING TIPS and FILING INSTRUCTIONS help you prepare your 2024 return * PLANNING REMINDERS highlight year-end tax strategies for 2024 and planning opportunities for 2025 and later years * CAUTIONS point out potential pitfalls to avoid and areas where you might expect IRS ...

The Most Trusted Name in Tax For over 80 years, more than 39 million Americans have trusted J.K. Lasser to help them save money at tax time J.K. Lasser can save you MORE money! Visit www.jklasser.com today for: * 365-day-a-year tax news, advice, and guidance * Free tax supplement Easy-to-Use Format Explains Complex Tax Laws * FILING TIPS and FILING INSTRUCTIONS help you prepare your 2024 return * PLANNING REMINDERS highlight year-end tax strategies for 2024 and planning opportunities for 2025 and later years * CAUTIONS point out potential pitfalls to avoid and areas where you might expect IRS opposition * LAW ALERTS indicate recent changes in the tax law and pending legislation before Congress * COURT DECISIONS highlight key rulings from the Tax Court and other federal courts * IRS ALERTS highlight key rulings and announcements from the IRS * STATE CONSIDERATIONS call attention to issues on State and Local tax returns Filing Basics (Part 1) - including: Intro & Filing Status - Chap. 1 Dependents - Chap. 2 Wages, Salary - Chap. 3 Fringe Benefits - Chap. 4 Dividend and Interest - Chap. 5 Property Sales - Chap. 6 Property Tax-Free Exchanges- Chap. 7 Retirement and Annuity - Chap. 8 IRAs - Chap. 9 Real Estate Rentals - Chap. 10 Loss Restrictions - Chap. 11 Other Income - Chap. 12 Claiming Deductions (Part 2) - including: Adjusted Gross Income - Chap. 13 Standard or Itemized - Chap. 14 Medical and Dental - Chap. 15 Deductions For Taxes - Chap. 16 Interest Expenses - Chap. 17 Charitable Contribution - Chap. 18 Casualty and Theft Losses - Chap. 19 Other Itemized Deductions - Chap. 20 Travel and Meal Expense - Chap. 21 Personal Tax Computations (Part 3) - including: Income Tax Liability - Chap. 22 Alternative Minimum Tax - Chap. 23 Child's Unearned Income - Chap. 24 Personal Tax Credits - Chap. 25 Tax Withholdings - Chap. 26 Estimated Tax Payments - Chap. 27 Medicare Tax - Chap. 28 Tax Planning (Part 4) - including: Residence Sales - Chap. 29 Investors in Securities - Chap. 30 Investors in Real Estate - Chap. 31 Investors in Mutual Funds - Chap. 32 Educational Benefits - Chap. 33 Senior Citizens - Chap. 34 Members of Armed Forces- Chap. 35 Foreign Earned Income - Chap. 36 Alimony Settlements - Chap. 37 Other Taxes - Chap. 38 Gift and Estate Tax - Chap. 39 Business Tax Planning (Part 5) - including: Income or Loss - Chap. 40 Plans for Self-Employed - Chap. 41 Claiming Depreciation - Chap. 42 Car and Truck Expenses - Chap. 43 Sales of Business Property - Chap. 44 Self-Employment Tax - Chap. 45 Filing your Return and What Happens after you File (Part 6) - including: Filing your Return - Chap. 46 Filing Refund Claims - Chap. 47 If IRS Examines your Return - Chap. 48