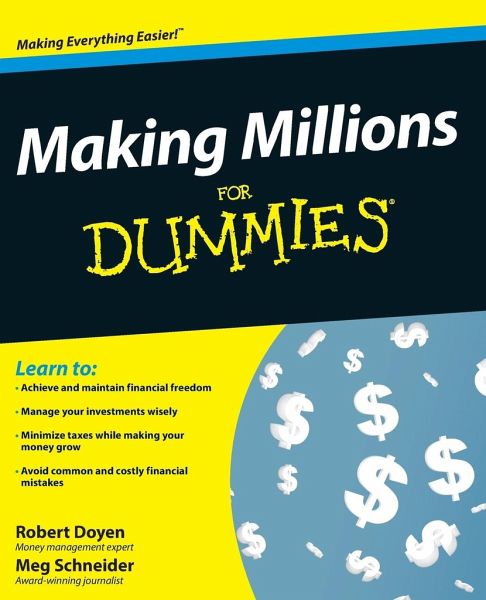

Making Millions for Dummies

Versandkostenfrei!

Versandfertig in über 4 Wochen

17,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

9 °P sammeln!

Learn to: * Achieve and maintain financial freedom * Manage your investments wisely * Minimize taxes while making your money grow * Avoid common and costly financial mistakes Your practical guide to taking control of your money and achieving great wealth Want to be a millionaire? You can! This no-nonsense guide shows you how to make your financial dreams come true with a proven method of saving, smart investing, and solid moneymaking opportunities. You'll see how to make wise financial decisions, minimize taxes, avoid costly mistakes, and ride out an unstable economy in order to reach your goa...

Learn to: * Achieve and maintain financial freedom * Manage your investments wisely * Minimize taxes while making your money grow * Avoid common and costly financial mistakes Your practical guide to taking control of your money and achieving great wealth Want to be a millionaire? You can! This no-nonsense guide shows you how to make your financial dreams come true with a proven method of saving, smart investing, and solid moneymaking opportunities. You'll see how to make wise financial decisions, minimize taxes, avoid costly mistakes, and ride out an unstable economy in order to reach your goals. * Get your finances in order -- understand your relationship with money and lay the groundwork for setting and meeting your financial security goals * Start building wealth today -- get rid of bad debt, start and stick to a savings plan, and maximize your paycheck * Begin a venture to make your millions -- explore proven wealth-building opportunities, including starting your own business, coming up with an invention, capitalizing on an inheritance, and investing in real estate * Manage your money wisely -- know your risk tolerance, get help from the pros, and minimize your tax liability * Plan for the unexpected and the inevitable -- protect your assets, plan for your heirs, and keep your finances in good health * Stay financially secure for the rest of your life -- reshape your attitude toward money and make the right financial security decisions Open the book and find: * What you can do to immediately improve your finances * The difference between good and bad debt * Proven strategies for building wealth * How to invest for income or growth * Money pitfalls and poor practices to avoid * Ways to free up your money and make it work for you * A plan for working out finances with your partner * Tips for protecting your credit-worthiness