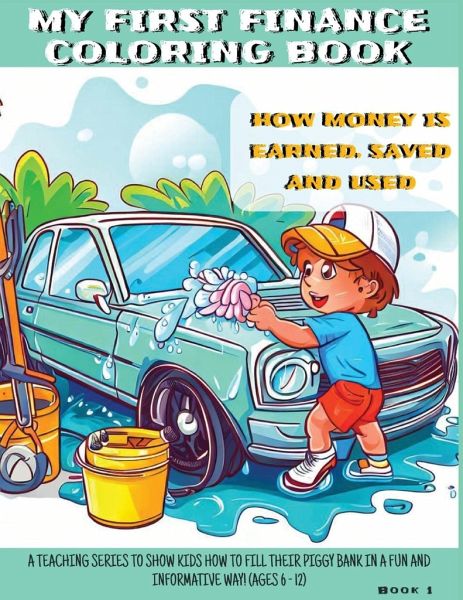

My First Finance Coloring Book

How is Money Earned, Saved, and Used

Versandkostenfrei!

Versandfertig in 1-2 Wochen

7,99 €

inkl. MwSt.

PAYBACK Punkte

4 °P sammeln!

Introduce your little one to the world of finance with Book 1 of the "My First Finance Book" series: 'How is money earned, saved, and used'. This fun and educational coloring book features 14 child-friendly lessons on doing chores to generate income, and then what to do with the income once its earned (spend vs. save in a piggy bank). Your child will learn how money is used to purchase things we want and need while having fun coloring in the pages. This book is perfect for children ages 6-12 who are just starting to learn about money and finance, but enjoy an interactive learning model.14 fun ...

Introduce your little one to the world of finance with Book 1 of the "My First Finance Book" series: 'How is money earned, saved, and used'. This fun and educational coloring book features 14 child-friendly lessons on doing chores to generate income, and then what to do with the income once its earned (spend vs. save in a piggy bank). Your child will learn how money is used to purchase things we want and need while having fun coloring in the pages. This book is perfect for children ages 6-12 who are just starting to learn about money and finance, but enjoy an interactive learning model.14 fun lessons to help guide your child's understanding of money Primary themes explored are: What is money and what is it used for? The concept of providing value to generate money - explored through common household chores Introduction to Saving and Delayed Gratification Black and White pages for easy coloring! 8.5 x 11" so there's plenty of room to draw! Perfect gift for parents with young children