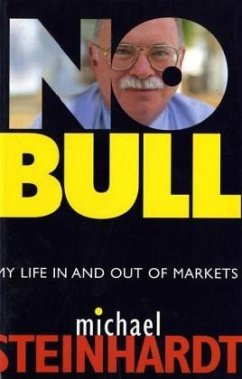

"No Bull" ist die lang ersehnte Autobiographie der Wall Street Legende Michael Steinhardt. Steinhardt gilt als einer der erfolgreichsten Investoren in der Geschichte der Wall Street. In der Zeit von 1967 bis 1995 häufte er für sich und seine Investoren ein Vermögen an. Mit einer alljährlichen Rendite von über 30% lag er weit über dem Marktdurchschnitt und übertraf fast jeden seiner Kollegen. Doch bis vor kurzem noch war er nicht bereit, viel über sich und seine Philosophie preiszugeben. Hinter Steinhardts phänomenalem Erfolg an der Wall Street steht sein soziales Engagement zum Wohl der jüdischen Gemeinschaft, das sich auf sein politisches Engagement als ehemaliger Chairman des Progressive Policy Institute und als früherer informeller Berater Clintons gründet. In "No Bull" enthüllt Steinhardt erstmals die Geheimnisse seines Erfolgs und ermöglicht dem Leser einen faszinierenden Einblick in seine philantrope Philosophie. Er bietet eine bestechend offene und inspirierende Darstellung seines kometenhaften Aufstiegs aus einfachen Verhältnissen bis hin an die Spitze der Wall Street. Eine fesselnde und bewegende Lektüre.

WITH APOLOGIES TO BALZAC, students of business will be forgiven for concluding that behind every great fortune is not necessarily a crime but, at the very least, a swine. If nice guys don't finish last, they rarely build empires, and in fact monomania appears so often in accounts of business success that it's hard to believe its presence is mere coincidence. Consider the outsized example of Michael Steinhardt. As one of Wall Street's most successful hedge-fund managers, his obsessive focus on performance made him the boss from hell, raging at subordinates and populating the Street with his firm's shell-shocked alumni. "All I want to do is kill myself, " says one chastened employee after mismanaging some bonds. "Can I watch?" Mr. Steinhardt replies coolly. When a psychiatrist is brought in, the staff members he meets use phrases like "battered children," "mental abuse" and "rage disorder." But when the hapless therapist mildly interrupts one of Mr. Steinhardt's red-faced tirades, he finds himself swept out the door on a tidal wave of invective. Mr. Steinhardt makes this case for his own swinishness in his modest and even touching memoir, "No Bull: My Life In and Out of Markets," and the result is a breath of fresh air in a traditionally windy genre. Although proud of his accomplishments--"one dollar invested with me in 1967 would have been worth $481 on the day I closed the firm in 1995, versus $19 if it had been invested in a Standard&Poor's index fund"--he dwells as much or more on his failings. He made a lousy soldier, can't control his weight or his temper, can't muster a faith in God to match his devotion to Judaism, and plunges into despair when he occasionally falls short of the impossible performance standards he strives to maintain. Paradoxically, the picture that emerges from the author's unremitting self-assessment is of a complex, learned and ultimately decent human being determined not just to struggle with his demons but to do something meaningful with his wealth. (Among other things, he finances a key organization for moderate Democrats and launches a drive to provide a free trip to Israel for every young Jew in the world.) Although he was raised by his selfless and loving mother, at the heart of Mr. Steinhardt's story is the author's deeply ambivalent relationship with his father. Sol Frank "Red" Steinhardt is a character right out of Saul Bellow or Philip Roth. A compulsive gambler from a tough section of Brooklyn who dropped out of school when he was 12, Red was married to Mr. Steinhardt's mother only long enough for Michael to be born. The elder Steinhardt, to whom Michael would come to bear an uncanny physical resemblance, drifted in and out of his son's life, turning up at crucial moments with sharp advice or a dubious pile of cash (besides gambling and hobnobbing with mobsters, Red dealt in stolen jewelry). Michael Steinhardt's education at the University of Pennsylvania, where he graduated at 19, and his earliest stake in the stock market were both underwritten by his father. Freudians will have afield day with this book, whose author clearly sublimated a familial predilection for financial risk into the socially acceptable outlet of the stock market. Mr. Steinhardt reports becoming obsessed with stocks during his impecunious boyhood and never letting go, even to this day, when he devotes himself mainly to charitable activities. Although he offers a cogent discussion of what kind of investments he looked for in his heyday, it's clear that at his Olympian level of achievement there are a lot of intangibles that the rest of us aren't going to learn from a book. Perhaps each of us just needs to get in touch with his inner monomaniac. (Wall Street Journal, November 6, 2001)