Numerical Methods for Finance

Versandkostenfrei!

Versandfertig in 6-10 Tagen

68,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

34 °P sammeln!

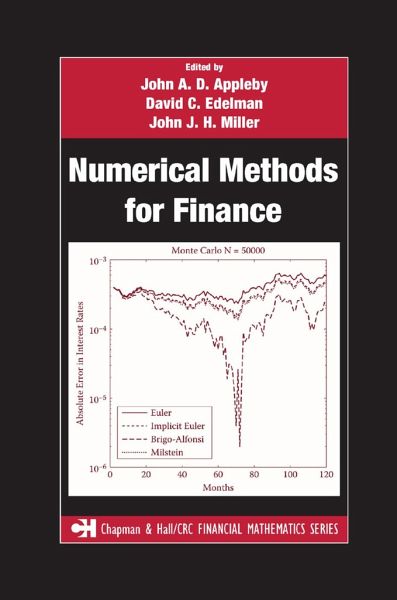

Featuring international contributors from both industry and academia, Numerical Methods for Finance explores new and relevant numerical methods for the solution of practical problems in finance. It is one of the few books entirely devoted to numerical methods as applied to the financial field.Presenting state-of-the-art methods in this area, the book first discusses the coherent risk measures theory and how it applies to practical risk management. It then proposes a new method for pricing high-dimensional American options, followed by a description of the negative inter-risk diversification ef...

Featuring international contributors from both industry and academia, Numerical Methods for Finance explores new and relevant numerical methods for the solution of practical problems in finance. It is one of the few books entirely devoted to numerical methods as applied to the financial field.

Presenting state-of-the-art methods in this area, the book first discusses the coherent risk measures theory and how it applies to practical risk management. It then proposes a new method for pricing high-dimensional American options, followed by a description of the negative inter-risk diversification effects between credit and market risk. After evaluating counterparty risk for interest rate payoffs, the text considers strategies and issues concerning defined contribution pension plans and participating life insurance contracts. It also develops a computationally efficient swaption pricing technology, extracts the underlying asset price distribution implied by option prices, and proposes a hybrid GARCH model as well as a new affine point process framework. In addition, the book examines performance-dependent options, variance reduction, Value at Risk (VaR), the differential evolution optimizer, and put-call-futures parity arbitrage opportunities.

Sponsored by DEPFA Bank, IDA Ireland, and Pioneer Investments, this concise and well-illustrated book equips practitioners with the necessary information to make important financial decisions.

Presenting state-of-the-art methods in this area, the book first discusses the coherent risk measures theory and how it applies to practical risk management. It then proposes a new method for pricing high-dimensional American options, followed by a description of the negative inter-risk diversification effects between credit and market risk. After evaluating counterparty risk for interest rate payoffs, the text considers strategies and issues concerning defined contribution pension plans and participating life insurance contracts. It also develops a computationally efficient swaption pricing technology, extracts the underlying asset price distribution implied by option prices, and proposes a hybrid GARCH model as well as a new affine point process framework. In addition, the book examines performance-dependent options, variance reduction, Value at Risk (VaR), the differential evolution optimizer, and put-call-futures parity arbitrage opportunities.

Sponsored by DEPFA Bank, IDA Ireland, and Pioneer Investments, this concise and well-illustrated book equips practitioners with the necessary information to make important financial decisions.