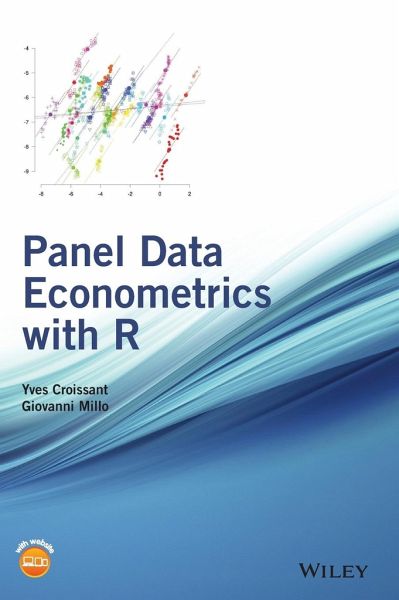

Panel Data Econometrics with R

Versandkostenfrei!

Versandfertig in über 4 Wochen

96,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

48 °P sammeln!

Panel Data Econometrics with R provides a tutorial for using R in the field of panel data econometrics.