Sketches in Quantitative Finance A Translation of Bachelier's Le Jeu, la Chance et le Hasard

PAYBACK Punkte

17 °P sammeln!

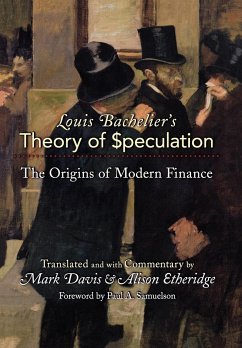

Forgotten amidst the dusty archives of French technical literature lies a delightful little gem written by Louis Bachelier in 1914 entitled Le Jeu, la chance et le hasard, or The Game, Luck and Randomness. Popular in pre-World War I France, Le Jeu… offered the general reader of the time original insights into quantifiable patterns found in both casino games and financial markets; it was perhaps one of the first "how to get rich quick" books. But its popularity did not survive the early 20th century upheavals in Europe and it was never translated and published into English. The book in hand, ...

Forgotten amidst the dusty archives of French technical literature lies a delightful little gem written by Louis Bachelier in 1914 entitled Le Jeu, la chance et le hasard, or The Game, Luck and Randomness. Popular in pre-World War I France, Le Jeu… offered the general reader of the time original insights into quantifiable patterns found in both casino games and financial markets; it was perhaps one of the first "how to get rich quick" books. But its popularity did not survive the early 20th century upheavals in Europe and it was never translated and published into English. The book in hand, Sketches in Quantitative Finance, is the only known English translation of Le Jeu, la chance et le hasard. It attempts to be a technically precise, word for word, translation of Bachelier's work, preserving his original tone and his refreshingly readable (albeit quirky) style of writing. While this translation's entertainment value is enhanced by the frequent nuggets of knowledge of Bachelier's mathematical perspectives, perhaps the greater pleasure to the English reader will be to experience a freshly exposed artifact of scientific philosophy.