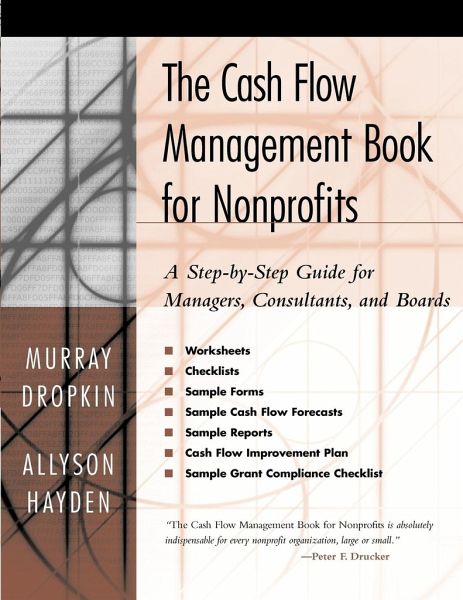

The Cash Flow Management Book for Nonprofits

A Step-by-Step Guide for Managers, Consultants, andBoards

Versandkostenfrei!

Versandfertig in über 4 Wochen

32,99 €

inkl. MwSt.

PAYBACK Punkte

16 °P sammeln!

"The Cash Flow Management Book for Nonprofits is absolutely indispensable for every nonprofit organization, large or small." --Peter F. Drucker * Worksheets * Checklists * Sample Forms * Sample Cash Flow Forecasts * Sample Reports * Cash Flow Improvement Plan * Sample Grant Compliance Checklist A Powerful Strategic Tool for Long-Term Financial Health Cash flow management is key to the financial health and overall success of a nonprofit organization. But many nonprofits address cash flow issues only when there is a problem, missing the opportunity to use cash flow as the powerful strategic tool...

"The Cash Flow Management Book for Nonprofits is absolutely indispensable for every nonprofit organization, large or small." --Peter F. Drucker * Worksheets * Checklists * Sample Forms * Sample Cash Flow Forecasts * Sample Reports * Cash Flow Improvement Plan * Sample Grant Compliance Checklist A Powerful Strategic Tool for Long-Term Financial Health Cash flow management is key to the financial health and overall success of a nonprofit organization. But many nonprofits address cash flow issues only when there is a problem, missing the opportunity to use cash flow as the powerful strategic tool it has the potential to be. In The Cash Flow Management Book for Nonprofits, financial management experts Murray Dropkin and Allyson Hayden present a powerful, strategic tool for the financial management of nonprofit organizations--no matter how large or small. The authors show nonprofit leaders how to create a proven plan for cash flow management and develop effective strategies for day-to-day and long-term financial planning. This nuts-and-bolts resource outlines the basics of cash flow management, explains the various revenue streams, and helps readers to identify their primary revenue sources and corresponding cash flow management strategies. In addition, this practical workbook is filled with to-do lists, sample forms, worksheets, schedules, policies and procedures, checklists, and more. Using the book's ideas and recommendations, any nonprofit can learn how to increase its income, improve its financial performance, and manage the resources that will help realize its mission. Advance Praise for The Cash Flow Management Book for Nonprofits "Murray Dropkin and Allyson Hayden have developed more than a practical how-to book on the critical issue of cash flow management. They provide comprehensive guidance for the financial expert and a context to enable the whole organization to develop a 'cash flow awareness.'" --Frances Hesselbein, chairman of the board of governors, the Peter F. Drucker Foundation for Nonprofit Management "Positive cash flow is the lifeblood of any organization, and Cash Flow Management is an essential guide to charting a course for success." --Ron Werthman, vice president of finance, treasurer, and CFO, Johns Hopkins Health System "The Cash Flow Management Book for Nonprofits takes the reader well beyond cash into the operational processes that generate it. The book reflects extraordinary insight into the real-life opportunities and pitfalls associated with managing nonprofit organizations." --David H. Freed, president and CEO, Nyack Hospital, Nyack, New York "This book provides every nonprofit, regardless of size or focus, with useful strategies for enhancing their bottom line through effective cash flow management." --Carol Wolff, president, the National Area Health Education Center (AHEC) Organization