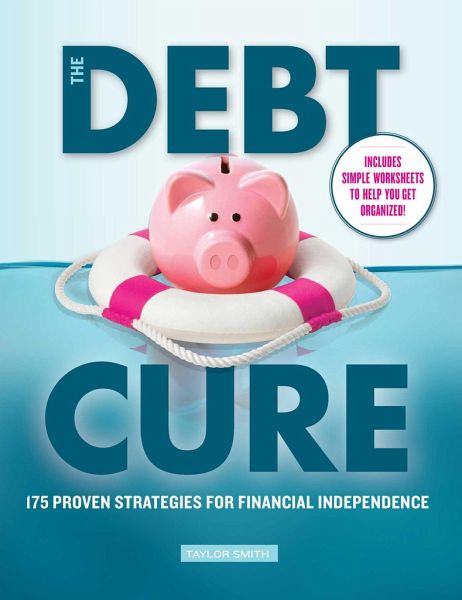

The Debt Cure

175 Proven Strategies for Financial Independence

Versandkostenfrei!

Versandfertig in 2-4 Wochen

19,99 €

inkl. MwSt.

PAYBACK Punkte

10 °P sammeln!

For many Americans, debt has become overwhelming—and in some cases unmanageable. This book is a primer to understanding how debt works, why we borrow and what to do when debt gets beyond our reach. Debt has become woven into the fabric of most Americans’ lives. We take out mortgages to buy our houses, borrow to pay for college, use it to own or lease our cars, and put purchases big and small on credit cards. From learning the ins and outs of the most common kinds of debt to understanding how interest rates and credit scores work, this book will give readers the information they need to...

For many Americans, debt has become overwhelming—and in some cases unmanageable. This book is a primer to understanding how debt works, why we borrow and what to do when debt gets beyond our reach. Debt has become woven into the fabric of most Americans’ lives. We take out mortgages to buy our houses, borrow to pay for college, use it to own or lease our cars, and put purchases big and small on credit cards. From learning the ins and outs of the most common kinds of debt to understanding how interest rates and credit scores work, this book will give readers the information they need to maintain a healthy relationship with debt. And if debt gets out of control, this book offers concrete steps readers can take to get—and stay—out of debt. Plus: Easy-to-use worksheets to more easily manage spending and eliminate debt with money saving tips for everyone.

Dieser Artikel kann nur an eine deutsche Lieferadresse ausgeliefert werden.