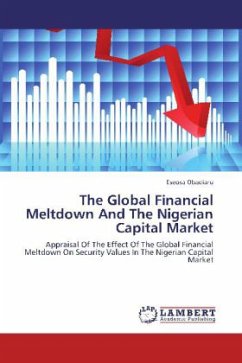

The Efficiency Of The Amman Financial Market

Investigate the Level of Efficiency of the Amman Financial Market in the Hashemite Kingdom of Jordan

Versandkostenfrei!

Versandfertig in 6-10 Tagen

32,99 €

inkl. MwSt.

PAYBACK Punkte

16 °P sammeln!

The efficiency of the financial market is very important to both researchers and investors in financial sectors, because all information available to investors would be reflected here and their ability to invest in the most efficient projects that guarantee the highest profitability would be enhanced. No single investor would be able to benefit form abnormal profit due to insider or prior information. This study sough to investigate the level of efficiency of the Amman Financial Market in the Hashemite Kingdom of Jordan. To achieve this objective two hypotheses were tested whether abnormal ret...

The efficiency of the financial market is very important to both researchers and investors in financial sectors, because all information available to investors would be reflected here and their ability to invest in the most efficient projects that guarantee the highest profitability would be enhanced. No single investor would be able to benefit form abnormal profit due to insider or prior information. This study sough to investigate the level of efficiency of the Amman Financial Market in the Hashemite Kingdom of Jordan. To achieve this objective two hypotheses were tested whether abnormal returns could be achieved in the Amman Financial Market due to insider information and whether information in the semi-annual report of the Amman Financial Market on the earnings per share have market value. Like most of the previous study, the results of this study showed that the Amman Financial Market is efficient since the null hypothesis of abnormal profit due to insider information was rejected. Furthermore, it was founded that the earnings per share has no significant effect on the market.