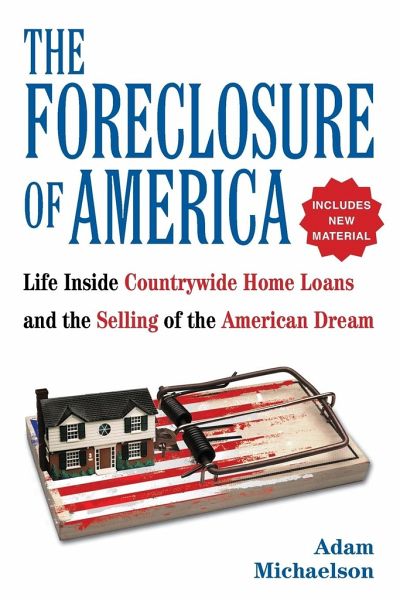

The Foreclosure of America

Life Inside Countrywide Home Loans and the Selling of the American Dream

Versandkostenfrei!

Versandfertig in 1-2 Wochen

21,99 €

inkl. MwSt.

PAYBACK Punkte

11 °P sammeln!

Now in paperback-an inside look at Countrywide Home Loans and the mortgage crisis, from a former mortgage lender executive. In July 2004, Adam Michaelson attended a high-level meeting at Countrywide Financial headquarters about a new loan product that would allow borrowers to pay less than their minimum monthly payment. The "finance jocks" believed that the booming housing market would only get bigger, supporting homeowners in a cycle of borrowing against their houses and refinancing later. They were wrong. And when the bottom dropped out, Countrywide suffered the consequences-as did millions ...

Now in paperback-an inside look at Countrywide Home Loans and the mortgage crisis, from a former mortgage lender executive. In July 2004, Adam Michaelson attended a high-level meeting at Countrywide Financial headquarters about a new loan product that would allow borrowers to pay less than their minimum monthly payment. The "finance jocks" believed that the booming housing market would only get bigger, supporting homeowners in a cycle of borrowing against their houses and refinancing later. They were wrong. And when the bottom dropped out, Countrywide suffered the consequences-as did millions of Americans. With an insider's knowledge and thorough reporting on the impact on American families and the ripple effects on the economy, Michaelson examines the marketing of a mirage and the bad business decisions that destroyed a company, confronts the ethical questions that have arisen in the wake of the foreclosure crisis, and offers creative proposals to prevent such a meltdown from ever happening again.