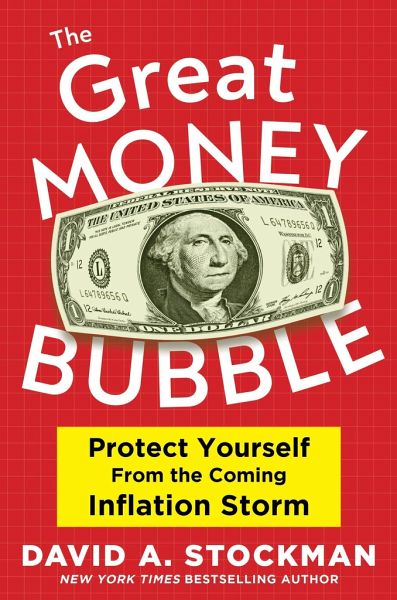

The Great Money Bubble

Protect Yourself from the Coming Inflation Storm

PAYBACK Punkte

11 °P sammeln!

"I urge everyone to read this important new book.”—Ron Paul, Host of Ron Paul Liberty Report Americans are facing sticker shock at every turn: from the gas pump to the grocery store and every kind of consumer service. But the eye-popping price increases are just the tip of the iceberg in terms of the threat to the country’s economic recovery. Inflation showers windfalls on the rich while penalizing workers, savers, retirees, small businesses, and most of Main Street economic life. New York Times bestselling author and former investment manager David A. Stockman, who served as director...

"I urge everyone to read this important new book.”—Ron Paul, Host of Ron Paul Liberty Report Americans are facing sticker shock at every turn: from the gas pump to the grocery store and every kind of consumer service. But the eye-popping price increases are just the tip of the iceberg in terms of the threat to the country’s economic recovery. Inflation showers windfalls on the rich while penalizing workers, savers, retirees, small businesses, and most of Main Street economic life. New York Times bestselling author and former investment manager David A. Stockman, who served as director of the Office of Management and Budget under President Reagan, explains the roots of today’s runaway inflation so investors at all levels can calibrate their financial strategies to survive and thrive despite economic uncertainty. The Great Money Bubble covers the entire economic landscape, including: * Why the rising price of assets is far more dangerous than rising consumer prices * The inside story on stock market manipulations and the effects of ultracheap debt * Why real estate is no longer a guaranteed inflationary hedge * Stockman’s four-step strategy to protect your savings and portfolio After spearheading the economic policy for the Reagan Revolution, Stockman worked on Wall Street at the highest levels, and is now an adviser to professional investors. With this book, readers at all investment levels can have access to his groundbreaking financial advice.