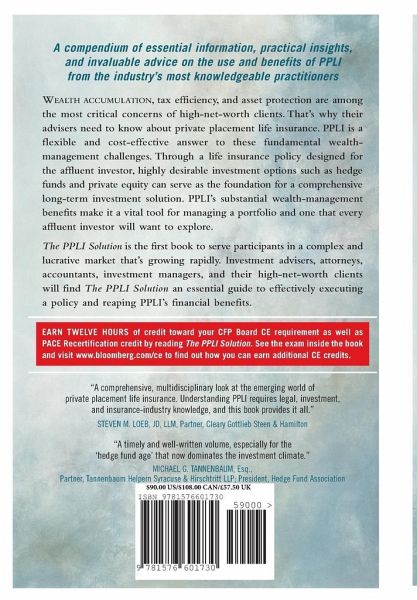

The Ppli Solution

Delivering Wealth Accumulation, Tax Efficiency, and Asset Protection Through Private Placement Life Insurance

Herausgeber: Loury, Kirk

Versandkostenfrei!

Versandfertig in über 4 Wochen

64,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

32 °P sammeln!

- Audience: Investment advisers, wealth managers, private bankers, trust officers, insurance advisers, accountants, trust and estate attorneys, high-net-worth individuals - The first book on a rapidly expanding market - PPLI is a "triple play" for wealthy investors, offering wealth creation, tax efficiency, and asset protection.