The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do about It

PAYBACK Punkte

8 °P sammeln!

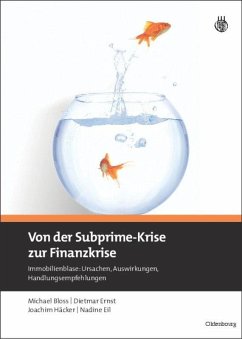

The subprime mortgage crisis has already wreaked havoc on the lives of millions of people and now it threatens to derail the U.S. economy and economies around the world. In this trenchant book, best-selling economist Robert Shiller reveals the origins of this crisis and puts forward bold measures to solve it. He calls for an aggressive response--a restructuring of the institutional foundations of the financial system that will not only allow people once again to buy and sell homes with confidence, but will create the conditions for greater prosperity in America and throughout the deeply interc...

The subprime mortgage crisis has already wreaked havoc on the lives of millions of people and now it threatens to derail the U.S. economy and economies around the world. In this trenchant book, best-selling economist Robert Shiller reveals the origins of this crisis and puts forward bold measures to solve it. He calls for an aggressive response--a restructuring of the institutional foundations of the financial system that will not only allow people once again to buy and sell homes with confidence, but will create the conditions for greater prosperity in America and throughout the deeply interconnected world economy.