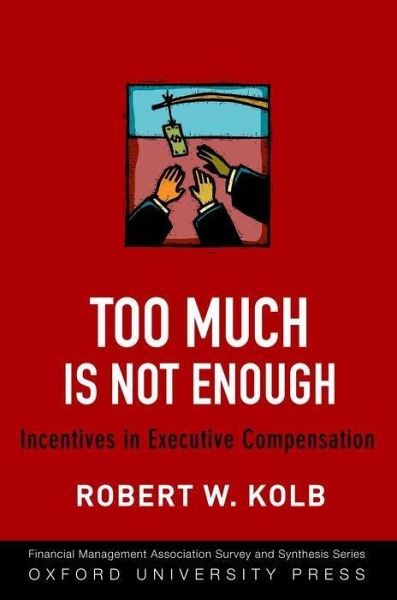

Too Much Is Never Enough

Incentives in Executive Compensation

PAYBACK Punkte

37 °P sammeln!

The scholarly literature on executive compensation is vast. As such, this literature provides an unparalleled resource for studying the interaction between the setting of incentives (or the attempted setting of incentives) and the behavior that is actually adduced. From this literature, there are several reasons for believing that one can set incentives in executive compensation with a high rate of success in guiding CEO behavior, and one might expect CEO compensation to be a textbook example of the successful use of incentives. Also, as executive compensation has been studied intensively in t...

The scholarly literature on executive compensation is vast. As such, this literature provides an unparalleled resource for studying the interaction between the setting of incentives (or the attempted setting of incentives) and the behavior that is actually adduced. From this literature, there are several reasons for believing that one can set incentives in executive compensation with a high rate of success in guiding CEO behavior, and one might expect CEO compensation to be a textbook example of the successful use of incentives. Also, as executive compensation has been studied intensively in the academic literature, we might also expect the success of incentive compensation to be well-documented. Historically, however, this has been very far from the case. In Too Much Is Not Enough, Robert W. Kolb studies the performance of incentives in executive compensation across many dimensions of CEO performance. The book begins with an overview of incentives and unintended consequences. Then it focuses on the theory of incentives as applied to compensation generally, and as applied to executive compensation particularly. Subsequent chapters explore different facets of executive compensation and assess the evidence on how well incentive compensation performs in each arena. The book concludes with a final chapter that provides an overall assessment of the value of incentives in guiding executive behavior. In it, Kolb argues that incentive compensation for executives is so problematic and so prone to error that the social value of giving huge incentive compensation packages is likely to be negative on balance. In focusing on incentives, the book provides a much sought-after resource, for while there are a number of books on executive compensation, none focuses specifically on incentives. Given the recent fervor over executive compensation, this unique but logical perspective will garner much interest. And while the literature being considered and evaluated is technical, the book is written in a non-mathematical way accessible to any college-educated reader.