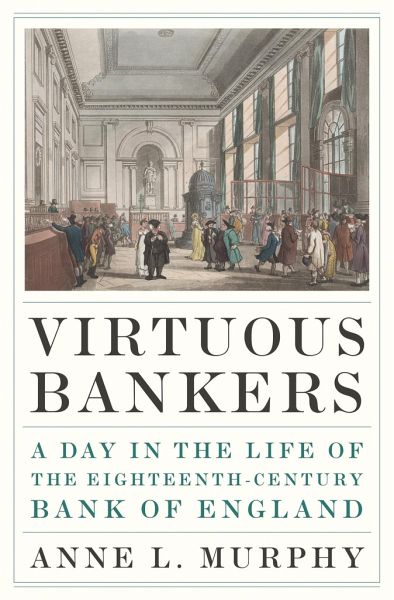

Virtuous Bankers

A Day in the Life of the Eighteenth-Century Bank of England

PAYBACK Punkte

20 °P sammeln!

An intimate account of the eighteenth-century Bank of England that shows how a private institution became 'a great engine of state'.