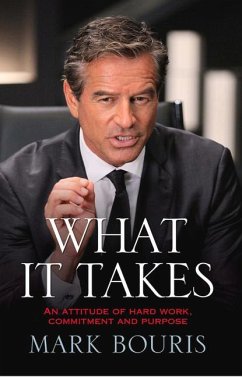

In 2002 Mark Bouris (founder of Wizard Home Loans, Australia) launched his first book, Wealth Wizard. The book covered the issue of personal debt: mortgages, credit cards, and loans. It showed normal Australians how borrowing could build wealth. Written by a person who made his own mistakes with borrowing as a younger man, the simple message of Wealth Wizard was that debt can be a tool rather than a burden. In the intervening five years many things have changed. People are more in debt than they were in 2002; credit card companies are in a price war, housing prices have fallen, and interest rates are going up. During this time, women have emerged as the fastest growing sector of mortgage-borrowers. And increasingly, friends, siblings, young people, and gay couples are combining to enter into the home-buying market using financial and legal arrangements not seen ten years ago. What's more, baby boomers - who are supposed to be in pre-retirement mode - have become one of the most aggressive groups of borrowers. Trends and societal shifts have made a rewritten, updated edition of the original book essential. Wealth Maker addresses all of the above and much, much more.

Hinweis: Dieser Artikel kann nur an eine deutsche Lieferadresse ausgeliefert werden.

Hinweis: Dieser Artikel kann nur an eine deutsche Lieferadresse ausgeliefert werden.