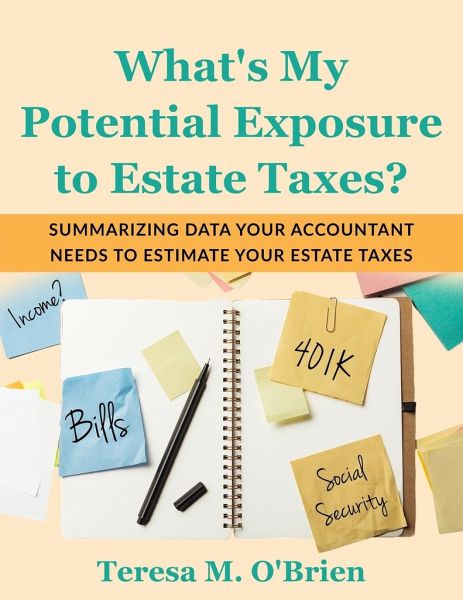

What's My Potential Exposure to Estate Taxes?

Versandkostenfrei!

Versandfertig in 1-2 Wochen

9,49 €

inkl. MwSt.

PAYBACK Punkte

5 °P sammeln!

What's My Potential Exposure to Estate Taxes? is designed specifically for people who have significant assets and want to assess the magnitude of their potential exposure to estate taxes. Do not use your net worth as a sole guide as to whether or not you have a potential estate tax bill. The IRS values many assets differently for estate tax purposes than a net worth calculation does. What's My Potential Exposure to Estate Taxes? will help organize your assets and liability information so you and your accountant can understand how much of your estate might be subject to taxes. It's like having ...

What's My Potential Exposure to Estate Taxes? is designed specifically for people who have significant assets and want to assess the magnitude of their potential exposure to estate taxes. Do not use your net worth as a sole guide as to whether or not you have a potential estate tax bill. The IRS values many assets differently for estate tax purposes than a net worth calculation does. What's My Potential Exposure to Estate Taxes? will help organize your assets and liability information so you and your accountant can understand how much of your estate might be subject to taxes. It's like having a guide to help your accountant help you. What's My Potential Exposure to Estate Taxes? summarizes your information consistent with IRS Form 706 for calculating estate taxes. The information in What's My Potential Exposure to Estate Taxes? is divided into 3 key areas - · total gross estate · allowable deductions and · generation skipping taxes Each of the subsections in these three key areas contains tables that correspond to the specific schedule in IRS Form 706. Save your accountant time and yourself money by pulling together this information for your accountant. This completed book can also be a ready reference for you going forward.