Why the Tax Year Begins on Sixth April

Versandkostenfrei!

Versandfertig in 1-2 Wochen

50,99 €

inkl. MwSt.

PAYBACK Punkte

25 °P sammeln!

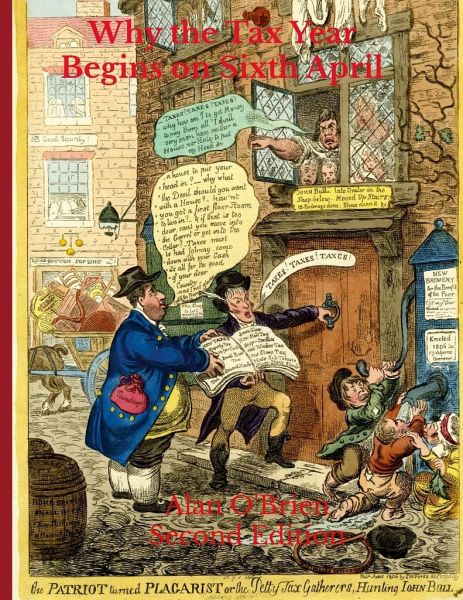

Second Edition 2024 This book explains why the UK tax year begins on 6 April and traces the history of the old tax year which ran from 25 March. It also covers other aspects of calendar history and related issues, including the continuing application of the 1750 British calendar reform statute to the USA and elsewhere. The move from the Julian to the Gregorian calendar in 1752 resulted in the omission of 11 days from September 1752. The omitted days were later added to the tax year and that apparently meant a new tax year beginning on 5 April - not 6 April. There are various explanations for t...

Second Edition 2024 This book explains why the UK tax year begins on 6 April and traces the history of the old tax year which ran from 25 March. It also covers other aspects of calendar history and related issues, including the continuing application of the 1750 British calendar reform statute to the USA and elsewhere. The move from the Julian to the Gregorian calendar in 1752 resulted in the omission of 11 days from September 1752. The omitted days were later added to the tax year and that apparently meant a new tax year beginning on 5 April - not 6 April. There are various explanations for the addition of a further day so the year began on 6 April, including the suggestion that a day was added in 1800. In fact the old tax year ran "from" 25 March and an ancient legal rule said "from" meant the year began on the following day, 26 March. Hence adding 11 days to 26 March produced a new tax year beginning on 6 April. It is often said that the Treasury extended the tax year by 11 days to avoid losing money. This is untrue. The Second Edition revises and expands particularly the key explanation on the way the tax year changed. The eBook from Lulu.com may help reading some of the Appendices which are in colour.