Anti fraud for Cheques and use of AI (eBook, ePUB)

Next gen realtime anti fraud 4 cheque processing

PAYBACK Punkte

0 °P sammeln!

This book brings A Comprehensive Analysis of Fraud Prevention in the Modern Landscape Introduction: Check Payments are an essential part of society and the global economy, but they are also vulnerable to fraud. Financial institutions and payment processors must provide secure and reliable payment options to customers, but this can be challenging as new payment methods and technologies are introduced and criminals find new ways to commit fraud. One solution to reduce risk and prevent financial losses is the use of technology, such as image analysis and pattern recognition, to improve the securi...

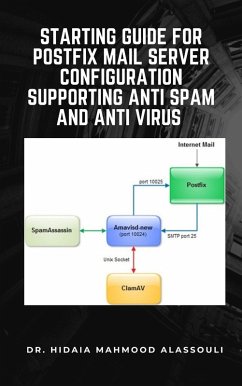

This book brings A Comprehensive Analysis of Fraud Prevention in the Modern Landscape Introduction: Check Payments are an essential part of society and the global economy, but they are also vulnerable to fraud. Financial institutions and payment processors must provide secure and reliable payment options to customers, but this can be challenging as new payment methods and technologies are introduced and criminals find new ways to commit fraud. One solution to reduce risk and prevent financial losses is the use of technology, such as image analysis and pattern recognition, to improve the security of vulnerable payment methods such as checks. Chapter 1: The Challenge of Check Fraud Check fraud is a significant problem, with losses estimated at $1.3 billion in the 2018 ABA Deposit Account Fraud Survey. Check fraud can occur through forgery, counterfeiting, alterations, kiting, and embezzlement, and new innovations in payment methods and technologies can lead to new methods of fraud. Despite efforts by banks to prevent check fraud, it remains a challenge. Chapter 2: Addressing the Endless Cycle of Payment Fraud Although the problem of payment fraud may seem like an endless cycle, it can be effectively addressed by analyzing past breaches, implementing comprehensive fraud control measures, and using current AI/ML technology to defend against fraud. One example of such technology is a check recognition system that uses image analysis and pattern recognition to provide protection for the vulnerable payment method of checks using trained AI models. By taking these steps, payment system participants can significantly reduce their risk of financial losses up to 99%. Chapter 3: The Changing Landscape of Payments The payments industry is undergoing change due to the decline in check usage, the growth of ACH and card, online, and mobile payments. Despite these changes, checks remain a widely used and important payment method, and organizations may find it challenging to switch from established and perceived secure payment methods. Consumers and businesses continue to use checks for a significant portion of their payments. Chapter 4: Next-gen real-time Cheque fraud detection using GAN AI/ML model. Newly patented and trained model using the GAN AI model to detect cheque fraud/counterfeit at the point of cheque accepted by financial institutions in real-time saves multi-millions and wins customer satisfaction at a higher level.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, HR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.