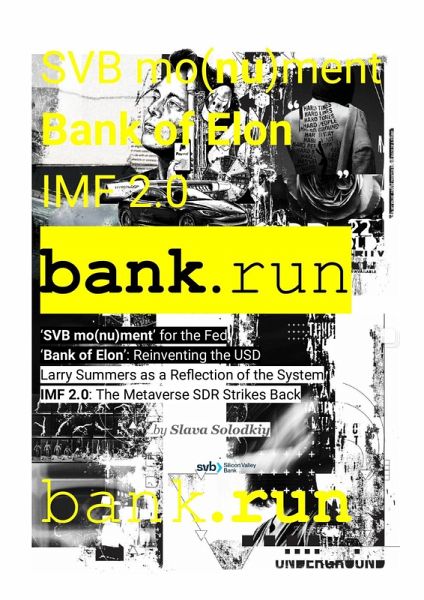

Bank of Elon: IMF 2.0 (eBook, ePUB)

PAYBACK Punkte

0 °P sammeln!

It's a tale of how the financial system, in its infinite wisdom, decided to cling to the good old days (think rotary phones and dial-up internet) while the rest of the world went and got itself a Tesla, a Twitter account, and a side hustle mining Bitcoin. The book begins with the collapse of Silicon Valley Bank, but it quickly makes clear: SVB is less the villain and more the hapless protagonist of a dark comedy. Here's a bank that bet the farm on low-interest rates staying low forever, only to be blindsided when reality decided to upend the poker table. Was it bad management? Sure. But the bo...

It's a tale of how the financial system, in its infinite wisdom, decided to cling to the good old days (think rotary phones and dial-up internet) while the rest of the world went and got itself a Tesla, a Twitter account, and a side hustle mining Bitcoin. The book begins with the collapse of Silicon Valley Bank, but it quickly makes clear: SVB is less the villain and more the hapless protagonist of a dark comedy. Here's a bank that bet the farm on low-interest rates staying low forever, only to be blindsided when reality decided to upend the poker table. Was it bad management? Sure. But the book argues SVB's real sin was trusting a system designed by regulators who seem to believe duct tape is an architectural tool.

Cue Larry Summers, playing the role of the over-earnest Greek chorus, wagging his finger at SVB's "bad choices" while conveniently forgetting that the whole system is a Rube Goldberg machine held together by spit and prayer. The irony is thicker than a Congressional banking reform bill: regulators who sleep through crises, experts who pontificate post-mortems, and a financial system so outdated it still thinks "maturity transformation" is a good idea.

Our fearless author, bless their nihilistic heart, starts by ripping into the corpse of Silicon Valley Bank, dissecting its failure with the glee of a teenager discovering a dead rat in the school cafeteria. But this isn't just about one bank's poor life choices - it's about the whole damn system.

The Federal Reserve, that bastion of stability and economic genius, gets a proper thrashing. Turns out, it's less a wise old sage and more a bunch of academics who haven't seen sunlight since the Great Depression, fiddling with interest rates while the world burns around them.

But wait, there's more! This book isn't just a gloriously cynical rant. It's also a psychedelic trip into the future of finance, where banks become lean, mean, monoline machines, and the dollar has to fight for its life against a horde of digital upstarts. We're talking stablecoins, CBDCs, and even Elon Musk's wet dream of a MarsCoin, all battling for a spot on the global financial chessboard. It's a future where regulators actually have to do their damn job, where innovation isn't a dirty word, and where the public might actually get a glimpse behind the curtain of the great money-making machine.

And yes, then there's Elon Musk, the book's enfant terrible, striding onto the stage like a meme lord armed with a financial bazooka. Musk, the perennial disruptor, sees the wreckage of traditional banking and thinks, Why not turn this into content? His vision of the "Bank of Elon" reads like a blend of sci-fi and satire: an ecosystem where Teslas become collateral, kilowatt-hours are currency, and Twitter (excuse me, "X") doubles as your local branch. The book invites you to laugh at Musk's hubris, then sheepishly consider whether you'd actually sign up for a MuskCoin savings account. (Spoiler: you probably would. Admit it.)

The book's most biting satire is reserved for regulators, depicted as bumbling bureaucrats caught in their own Kafkaesque labyrinth. Picture a masquerade ball where every agency-FDIC, OCC, Federal Reserve-wears a mask labeled "We've Got This," while frantically tripping over each other's capes. The result? A financial system that, as the book puts it, "works perfectly, except when it doesn't."

So, if you're tired of the same old boring finance books that read like a sleeping pill, this one's for you. It's a wild ride, a sarcastic symphony, a grotesque ballet of financial grotesquery. It'll make you laugh, it'll make you cry, it might even make you want to go full-on anarchist and start your own cryptocurrency backed by nothing but cat memes and empty pizza boxes. Just don't read it while operating heavy machinery or trying to file your taxes.

Cue Larry Summers, playing the role of the over-earnest Greek chorus, wagging his finger at SVB's "bad choices" while conveniently forgetting that the whole system is a Rube Goldberg machine held together by spit and prayer. The irony is thicker than a Congressional banking reform bill: regulators who sleep through crises, experts who pontificate post-mortems, and a financial system so outdated it still thinks "maturity transformation" is a good idea.

Our fearless author, bless their nihilistic heart, starts by ripping into the corpse of Silicon Valley Bank, dissecting its failure with the glee of a teenager discovering a dead rat in the school cafeteria. But this isn't just about one bank's poor life choices - it's about the whole damn system.

The Federal Reserve, that bastion of stability and economic genius, gets a proper thrashing. Turns out, it's less a wise old sage and more a bunch of academics who haven't seen sunlight since the Great Depression, fiddling with interest rates while the world burns around them.

But wait, there's more! This book isn't just a gloriously cynical rant. It's also a psychedelic trip into the future of finance, where banks become lean, mean, monoline machines, and the dollar has to fight for its life against a horde of digital upstarts. We're talking stablecoins, CBDCs, and even Elon Musk's wet dream of a MarsCoin, all battling for a spot on the global financial chessboard. It's a future where regulators actually have to do their damn job, where innovation isn't a dirty word, and where the public might actually get a glimpse behind the curtain of the great money-making machine.

And yes, then there's Elon Musk, the book's enfant terrible, striding onto the stage like a meme lord armed with a financial bazooka. Musk, the perennial disruptor, sees the wreckage of traditional banking and thinks, Why not turn this into content? His vision of the "Bank of Elon" reads like a blend of sci-fi and satire: an ecosystem where Teslas become collateral, kilowatt-hours are currency, and Twitter (excuse me, "X") doubles as your local branch. The book invites you to laugh at Musk's hubris, then sheepishly consider whether you'd actually sign up for a MuskCoin savings account. (Spoiler: you probably would. Admit it.)

The book's most biting satire is reserved for regulators, depicted as bumbling bureaucrats caught in their own Kafkaesque labyrinth. Picture a masquerade ball where every agency-FDIC, OCC, Federal Reserve-wears a mask labeled "We've Got This," while frantically tripping over each other's capes. The result? A financial system that, as the book puts it, "works perfectly, except when it doesn't."

So, if you're tired of the same old boring finance books that read like a sleeping pill, this one's for you. It's a wild ride, a sarcastic symphony, a grotesque ballet of financial grotesquery. It'll make you laugh, it'll make you cry, it might even make you want to go full-on anarchist and start your own cryptocurrency backed by nothing but cat memes and empty pizza boxes. Just don't read it while operating heavy machinery or trying to file your taxes.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, CY, CZ, D, DK, EW, E, FIN, F, GR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.