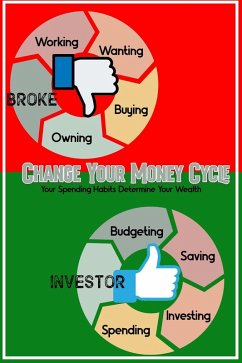

The other 5-10% use the "investor" money cycle that entails budgeting, saving, investing, and spending.

The key before between the two is cash flow. The "broke" use cash flow to buy liabilities, while "investors" use cash flow to purchase income-producing assets.

And guess what? Income-producing assets (like dividends) produce more income for you. So each month, you become wealthier and have more cash flowit's a glorious cycle. You can convert to this money system if you choose. Good Luck!

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, CY, CZ, D, DK, EW, E, FIN, F, GR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.