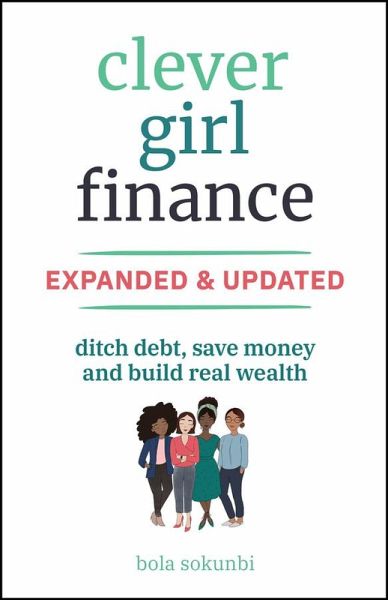

Clever Girl Finance, Expanded & Updated (eBook, PDF)

Ditch Debt, Save Money and Build Real Wealth

Versandkostenfrei!

Sofort per Download lieferbar

17,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

0 °P sammeln!

Secure your financial independence and security with small, simple, yet powerful action steps you can take starting today!In the newly revised second edition to Clever Girl Finance, celebrated personal finance educator Bola Sokunbi delivers an update to the insightful and entertaining installment of her widely read handbook to personal finance for women everywhere. The author walks you through the basics of building a strong and prosperous financial future, showing you how to craft a resilient budget, improve your credit score, pay down debt, invest and build long term wealth.With this book, y...

Secure your financial independence and security with small, simple, yet powerful action steps you can take starting today!

In the newly revised second edition to Clever Girl Finance, celebrated personal finance educator Bola Sokunbi delivers an update to the insightful and entertaining installment of her widely read handbook to personal finance for women everywhere. The author walks you through the basics of building a strong and prosperous financial future, showing you how to craft a resilient budget, improve your credit score, pay down debt, invest and build long term wealth.

With this book, you'll:

Perfect for women looking for practical advice, actionable steps, and real-life examples they can apply to their own financial journey, Clever Girl Finance is an invaluable resource for anyone who wants to achieve financial independence and success!

In the newly revised second edition to Clever Girl Finance, celebrated personal finance educator Bola Sokunbi delivers an update to the insightful and entertaining installment of her widely read handbook to personal finance for women everywhere. The author walks you through the basics of building a strong and prosperous financial future, showing you how to craft a resilient budget, improve your credit score, pay down debt, invest and build long term wealth.

With this book, you'll:

- Identify your personal money values, goals, and beliefs to help guide your actions.

- Explore mindset shifts and developing good financial habits including overcoming limiting beliefs about money and cultivating healthy financial habits.

- Learn strategies to effectively manage and eliminate debt, such as creating a debt repayment plan, negotiating lower interest rates, and prioritizing high-interest debt.

- Gain insights into different saving strategies, including emergency funds, retirement savings, and other long-term financial goals.

- Learn about different investment options, risk management, and how to start investing even with a small amount of money.

- And much more

Perfect for women looking for practical advice, actionable steps, and real-life examples they can apply to their own financial journey, Clever Girl Finance is an invaluable resource for anyone who wants to achieve financial independence and success!

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in D ausgeliefert werden.