Hedge Hogs: The Cowboy Traders Behind Wall Street's Largest Hedge Fund Disaster (eBook, ePUB)

PAYBACK Punkte

0 °P sammeln!

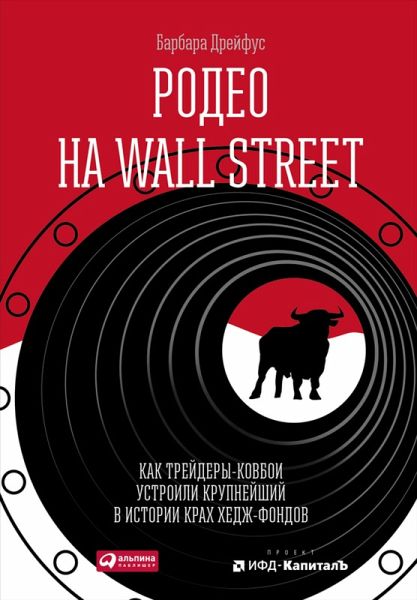

In September 2006, in just a week, one of America's leading hedge funds, Amaranth Advisors, lost almost 65% of its assets - more than $ 6 billion. The catastrophic collapse of the company shocked not only the entire commodity market, but also the pension funds that invested in it. How could this happen? What actually happened behind the closed doors of hedge funds that were outside of government regulation? The investigation by Barbara Dreyfuss, a 20-year-old Wall Street analyst, restores the historical context of those events, and most importantly, paints a psychological portrait of the two m...

In September 2006, in just a week, one of America's leading hedge funds, Amaranth Advisors, lost almost 65% of its assets - more than $ 6 billion. The catastrophic collapse of the company shocked not only the entire commodity market, but also the pension funds that invested in it. How could this happen? What actually happened behind the closed doors of hedge funds that were outside of government regulation? The investigation by Barbara Dreyfuss, a 20-year-old Wall Street analyst, restores the historical context of those events, and most importantly, paints a psychological portrait of the two main participants in this crazy rodeo in the natural gas market - Brian Hunter and John Arnold.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.