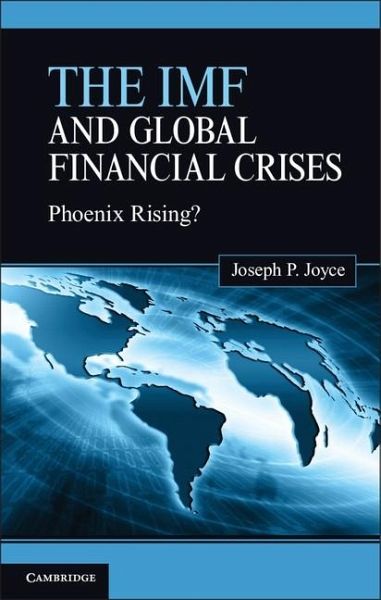

IMF and Global Financial Crises (eBook, ePUB)

Phoenix Rising?

PAYBACK Punkte

11 °P sammeln!

The IMF's response to the global crisis of 2008-9 marked a significant change from its past policies. The Fund provided relatively large amounts of credit quickly with limited conditions and accepted the use of capital controls. This book traces the evolution of the IMF's actions to promote international financial stability from the Bretton Woods era through the most recent crisis. The analysis includes an examination of the IMF's crisis management activities during the debt crisis of the 1980s, the upheavals in emerging markets in the 1990s and early 2000s, and the ongoing European crisis. Th...

The IMF's response to the global crisis of 2008-9 marked a significant change from its past policies. The Fund provided relatively large amounts of credit quickly with limited conditions and accepted the use of capital controls. This book traces the evolution of the IMF's actions to promote international financial stability from the Bretton Woods era through the most recent crisis. The analysis includes an examination of the IMF's crisis management activities during the debt crisis of the 1980s, the upheavals in emerging markets in the 1990s and early 2000s, and the ongoing European crisis. The dominant influence of the United States and other advanced economies in the governance of the IMF is also described, and the replacement of the G7 nations by the more inclusive G20, which have promised to give the IMF a role in their mutual assessment of policies while undertaking reforms of the IMF's governance.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, HR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.