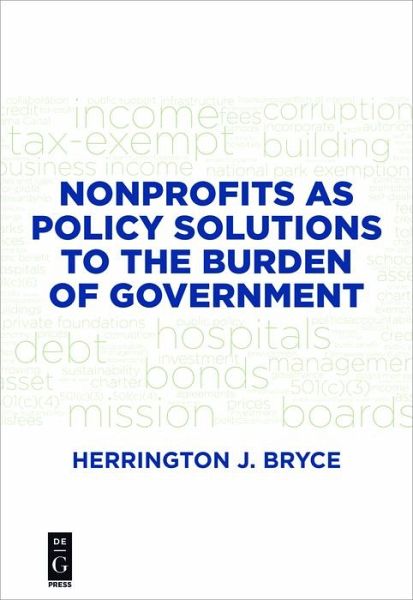

Nonprofits as Policy Solutions to the Burden of Government (eBook, ePUB)

Versandkostenfrei!

Sofort per Download lieferbar

38,95 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

19 °P sammeln!

This book addresses a specific subset of nonprofits that are chartered with a single mission: decrease the burden of government. Designing and engaging nonprofits to lessen the burden of government requires a specific description and acknowledgement of the burden to be lessened, and these may include the provision of infrastructure, the relief of debt, or the provision of general public services that are not motivated by charity. It also requires the assignment of specific operating powers to the nonprofit including the power of eminent domain. This book explores these and other related topics...

This book addresses a specific subset of nonprofits that are chartered with a single mission: decrease the burden of government. Designing and engaging nonprofits to lessen the burden of government requires a specific description and acknowledgement of the burden to be lessened, and these may include the provision of infrastructure, the relief of debt, or the provision of general public services that are not motivated by charity. It also requires the assignment of specific operating powers to the nonprofit including the power of eminent domain. This book explores these and other related topics including the avoidance of resource dependence on government when attempting to reduce its burden.

The book is addressed to the policy makers and rule makers who design policies that affect the ability of the nonprofit to effectively lessen the burden of government. It is also addressed to public administrators in search of innovative ways of implementing these policies consistent with the laws, and to the creative nonprofit managers who are charged with carrying out the mission often in collaboration with the government or other entities. To the advanced student in all related fields, the author offers not only material for discussion, but enables discovery of what is possible by giving key examples of organizations meeting the terms and objective of lessening a significant burden of government.

The book is addressed to the policy makers and rule makers who design policies that affect the ability of the nonprofit to effectively lessen the burden of government. It is also addressed to public administrators in search of innovative ways of implementing these policies consistent with the laws, and to the creative nonprofit managers who are charged with carrying out the mission often in collaboration with the government or other entities. To the advanced student in all related fields, the author offers not only material for discussion, but enables discovery of what is possible by giving key examples of organizations meeting the terms and objective of lessening a significant burden of government.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, HR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.