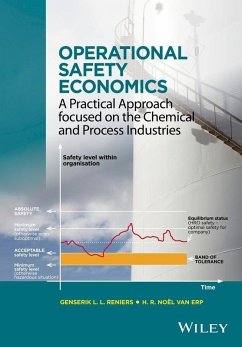

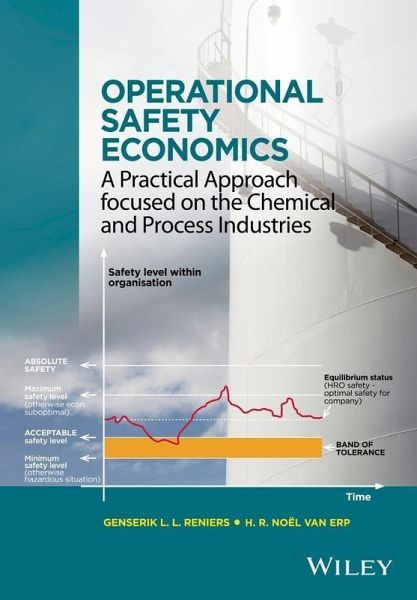

Operational Safety Economics (eBook, PDF)

A Practical Approach focused on the Chemical and Process Industries

Versandkostenfrei!

Sofort per Download lieferbar

114,99 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

0 °P sammeln!

Describes how to make economic decisions regading safety in the chemical and process industries * Covers both technical risk assessment and economic aspects of safety decision-making * Suitable for both academic researchers and practitioners in industry * Addresses cost-benefit analysis for safety investments

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in D ausgeliefert werden.