Portfolio Optimization (eBook, ePUB)

Versandkostenfrei!

Sofort per Download lieferbar

55,95 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

28 °P sammeln!

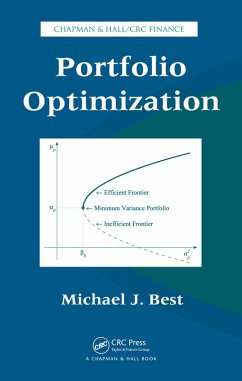

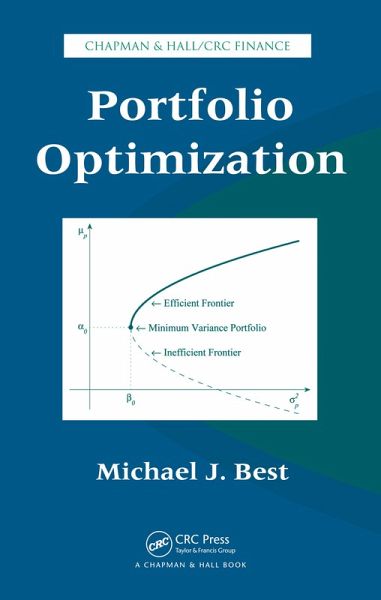

Eschewing a more theoretical approach, Portfolio Optimization shows how the mathematical tools of linear algebra and optimization can quickly and clearly formulate important ideas on the subject. This practical book extends the concepts of the Markowitz "budget constraint only" model to a linearly constrained model.Only requiring elementary linear algebra, the text begins with the necessary and sufficient conditions for optimal quadratic minimization that is subject to linear equality constraints. It then develops the key properties of the efficient frontier, extends the results to problems wi...

Eschewing a more theoretical approach, Portfolio Optimization shows how the mathematical tools of linear algebra and optimization can quickly and clearly formulate important ideas on the subject. This practical book extends the concepts of the Markowitz "budget constraint only" model to a linearly constrained model.

Only requiring elementary linear algebra, the text begins with the necessary and sufficient conditions for optimal quadratic minimization that is subject to linear equality constraints. It then develops the key properties of the efficient frontier, extends the results to problems with a risk-free asset, and presents Sharpe ratios and implied risk-free rates. After focusing on quadratic programming, the author discusses a constrained portfolio optimization problem and uses an algorithm to determine the entire (constrained) efficient frontier, its corner portfolios, the piecewise linear expected returns, and the piecewise quadratic variances. The final chapter illustrates infinitely many implied risk returns for certain market portfolios.

Drawing on the author's experiences in the academic world and as a consultant to many financial institutions, this text provides a hands-on foundation in portfolio optimization. Although the author clearly describes how to implement each technique by hand, he includes several MATLAB® programs designed to implement the methods and offers these programs on the accompanying downloadable resources.

Only requiring elementary linear algebra, the text begins with the necessary and sufficient conditions for optimal quadratic minimization that is subject to linear equality constraints. It then develops the key properties of the efficient frontier, extends the results to problems with a risk-free asset, and presents Sharpe ratios and implied risk-free rates. After focusing on quadratic programming, the author discusses a constrained portfolio optimization problem and uses an algorithm to determine the entire (constrained) efficient frontier, its corner portfolios, the piecewise linear expected returns, and the piecewise quadratic variances. The final chapter illustrates infinitely many implied risk returns for certain market portfolios.

Drawing on the author's experiences in the academic world and as a consultant to many financial institutions, this text provides a hands-on foundation in portfolio optimization. Although the author clearly describes how to implement each technique by hand, he includes several MATLAB® programs designed to implement the methods and offers these programs on the accompanying downloadable resources.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, HR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.