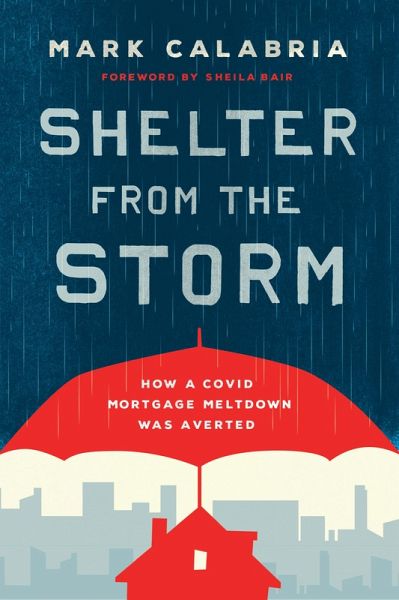

Shelter from the Storm (eBook, ePUB)

How a COVID Mortgage Meltdown Was Averted

Versandkostenfrei!

Sofort per Download lieferbar

8,95 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

4 °P sammeln!

This is a story about how you can directly help Main Street without bailing out Wall Street.The COVID-19 pandemic upended our daily lives and transformed the political landscape. The crisis was not only an unprecedented shock to our health care system but also an unprecedented threat to our economic well-being, including the mortgage and housing markets. While the primary focus of the federal response was appropriately on public health, a critical aspect of that response was the efforts to keep families in their homes.Despite the reforms following the 2008 financial crisis, our financial marke...

This is a story about how you can directly help Main Street without bailing out Wall Street.

The COVID-19 pandemic upended our daily lives and transformed the political landscape. The crisis was not only an unprecedented shock to our health care system but also an unprecedented threat to our economic well-being, including the mortgage and housing markets. While the primary focus of the federal response was appropriately on public health, a critical aspect of that response was the efforts to keep families in their homes.

Despite the reforms following the 2008 financial crisis, our financial markets were not prepared. March 2020 brought another financial crisis, moderated by the responses of our financial regulators. Calls for bailouts rose again, but some were determined not to repeat the many mistakes of 2008.

As director of the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, Mark Calabria was responsible for leading that response. In Shelter from the Storm, he tells the story of how millions of families were provided mortgage and rental assistance both to keep them safe and to keep our financial markets functioning. He offers readers a peek behind the curtain of government decisionmaking in a crisis and shows how the FHFA minimized housing disruptions at little to no cost to the taxpayer and resisted repeated calls for industry bailouts and subsidies.

The COVID-19 pandemic upended our daily lives and transformed the political landscape. The crisis was not only an unprecedented shock to our health care system but also an unprecedented threat to our economic well-being, including the mortgage and housing markets. While the primary focus of the federal response was appropriately on public health, a critical aspect of that response was the efforts to keep families in their homes.

Despite the reforms following the 2008 financial crisis, our financial markets were not prepared. March 2020 brought another financial crisis, moderated by the responses of our financial regulators. Calls for bailouts rose again, but some were determined not to repeat the many mistakes of 2008.

As director of the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, Mark Calabria was responsible for leading that response. In Shelter from the Storm, he tells the story of how millions of families were provided mortgage and rental assistance both to keep them safe and to keep our financial markets functioning. He offers readers a peek behind the curtain of government decisionmaking in a crisis and shows how the FHFA minimized housing disruptions at little to no cost to the taxpayer and resisted repeated calls for industry bailouts and subsidies.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, D ausgeliefert werden.