Stochastic Modelling of Big Data in Finance (eBook, PDF)

Versandkostenfrei!

Sofort per Download lieferbar

83,95 €

inkl. MwSt.

Weitere Ausgaben:

PAYBACK Punkte

42 °P sammeln!

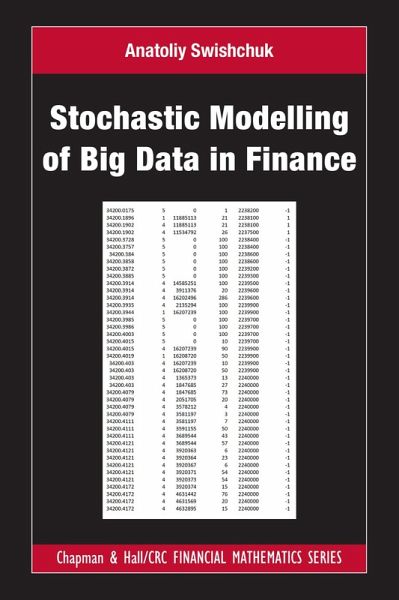

Stochastic Modelling of Big Data in Finance provides a rigorous overview and exploration of stochastic modelling of big data in finance (BDF). The book describes various stochastic models, including multivariate models, to deal with big data in finance. This includes data in high-frequency and algorithmic trading, specifically in limit order books (LOB), and shows how those models can be applied to different datasets to describe the dynamics of LOB, and to figure out which model is the best with respect to a specific data set. The results of the book may be used to also solve acquisition, liqu...

Stochastic Modelling of Big Data in Finance provides a rigorous overview and exploration of stochastic modelling of big data in finance (BDF). The book describes various stochastic models, including multivariate models, to deal with big data in finance. This includes data in high-frequency and algorithmic trading, specifically in limit order books (LOB), and shows how those models can be applied to different datasets to describe the dynamics of LOB, and to figure out which model is the best with respect to a specific data set. The results of the book may be used to also solve acquisition, liquidation and market making problems, and other optimization problems in finance.

Features

Dr. Anatoliy Swishchuk is a Professor in Mathematical Finance at the Department of Mathematics and Statistics, University of Calgary, Calgary, AB, Canada. He got his B.Sc. and M.Sc. degrees from Kyiv State University, Kyiv, Ukraine. He earned two doctorate degrees in Mathematics and Physics (PhD and DSc) from the prestigious National Academy of Sciences of Ukraine (NASU), Kiev, Ukraine, and is a recipient of NASU award for young scientist with a gold medal for series of research publications in random evolutions and their applications.

Dr. Swishchuk is a chair and organizer of finance and energy finance seminar 'Lunch at the Lab' at the Department of Mathematics and Statistics. Dr. Swishchuk is a Director of Mathematical and Computational Finance Laboratory at the University of Calgary. He was a steering committee member of the Professional Risk Managers International Association (PRMIA), Canada (2006-2015), and is a steering committee member of Global Association of Risk Professionals (GARP), Canada (since 2015).

Dr. Swishchuk is a creator of mathematical finance program at the Department of Mathematics & Statistics. He is also a proponent for a new specialization "Financial and Energy Markets Data Modelling" in the Data Science and Analytics program. His research areas include financial mathematics, random evolutions and their applications, biomathematics, stochastic calculus, and he serves on editorial boards for four research journals. He is the author of more than 200 publications, including 15 books and more than 150 articles in peer-reviewed journals. In 2018 he received a Peak Scholar award.

Features

- Self-contained book suitable for graduate students and post-doctoral fellows in financial mathematics and data science, as well as for practitioners working in the financial industry who deal with big data

- All results are presented visually to aid in understanding of concepts

Dr. Anatoliy Swishchuk is a Professor in Mathematical Finance at the Department of Mathematics and Statistics, University of Calgary, Calgary, AB, Canada. He got his B.Sc. and M.Sc. degrees from Kyiv State University, Kyiv, Ukraine. He earned two doctorate degrees in Mathematics and Physics (PhD and DSc) from the prestigious National Academy of Sciences of Ukraine (NASU), Kiev, Ukraine, and is a recipient of NASU award for young scientist with a gold medal for series of research publications in random evolutions and their applications.

Dr. Swishchuk is a chair and organizer of finance and energy finance seminar 'Lunch at the Lab' at the Department of Mathematics and Statistics. Dr. Swishchuk is a Director of Mathematical and Computational Finance Laboratory at the University of Calgary. He was a steering committee member of the Professional Risk Managers International Association (PRMIA), Canada (2006-2015), and is a steering committee member of Global Association of Risk Professionals (GARP), Canada (since 2015).

Dr. Swishchuk is a creator of mathematical finance program at the Department of Mathematics & Statistics. He is also a proponent for a new specialization "Financial and Energy Markets Data Modelling" in the Data Science and Analytics program. His research areas include financial mathematics, random evolutions and their applications, biomathematics, stochastic calculus, and he serves on editorial boards for four research journals. He is the author of more than 200 publications, including 15 books and more than 150 articles in peer-reviewed journals. In 2018 he received a Peak Scholar award.

Dieser Download kann aus rechtlichen Gründen nur mit Rechnungsadresse in A, B, BG, CY, CZ, D, DK, EW, E, FIN, F, GR, HR, H, IRL, I, LT, L, LR, M, NL, PL, P, R, S, SLO, SK ausgeliefert werden.