Robert N Gordon

Gebundenes Buch

Wall Street Secrets for Tax-Efficient Investing

From Tax Pain to Investment Gain

Versandkostenfrei!

Versandfertig in über 4 Wochen

PAYBACK Punkte

14 °P sammeln!

Bob Gordon, a Wall Street veteran, shares the sage strategies of an insider to demonstrate how readers can take advantage of tax law instead of letting taxes take advantage of them.

ROBERT N. GORDON is the president and owner of Twenty-First Securities Corporation, which provides investment advice and financial management for corporate, institutional, and individual clients. He was formerly a partner at Oppenheimer & Company and chairman of the Securities Industry Association's Tax Policy Committee. He is also an adjunct professor at New York University's Graduate School of Business and is a much sought-after speaker at industry conferences. JAN M. ROSEN, a long-time editor and former tax columnist in the financial news department of The New York Times, has been responsible for that newspaper's annual tax section for many years. In addition, she is a contributor to Tax Hotline and other newsletters published by Boardroom, Inc. Rosen holds a master's degree from Columbia University in New York, where she attended the Graduate School of Journalism.

Produktdetails

- Verlag: Wiley

- Seitenzahl: 288

- Erscheinungstermin: 1. November 2001

- Englisch

- Abmessung: 235mm x 157mm x 22mm

- Gewicht: 638g

- ISBN-13: 9781576600887

- ISBN-10: 1576600882

- Artikelnr.: 21643098

Herstellerkennzeichnung

Libri GmbH

Europaallee 1

36244 Bad Hersfeld

gpsr@libri.de

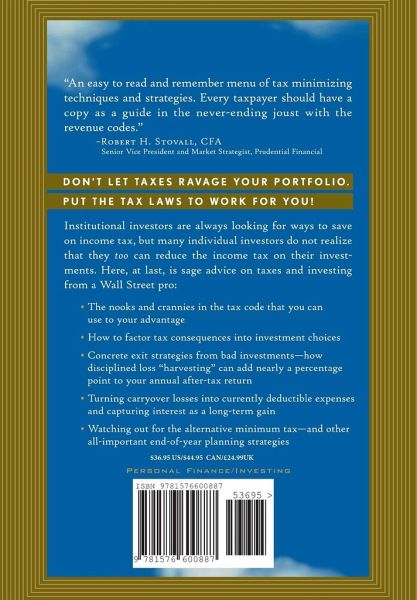

"Bob Gordon and Jan Rosen know that it's what you keeprather than how much you earn that really counts. This bookprovides an easy-to-read-and-remember menu of tax-minimizingtechniques and strategies. Every taxpayer should have a copy asa guide in the never-ending joust with the revenuecodes."

--Robert H. Stovall, CFA

Senior Vice President and Market Strategist, PrudentialFinancial

"Understanding the growing range of tax-efficientinvesting alternatives is no longer anoption--it's a critical element of soundfinancial planning. This book is an essential tool for graspingand maximizing today's rapidly expanding menu of innovativeinvestment choices."

--Peter Quick

President, American Stock Exchange

"If you hate taxes, you'll love this book!Authors Robert Gordon and Jan Rosen reveal a catalogue oftax-cutting strategies for taxpayers and investors."

--Ed Slott, CPA

Editor, Ed Slotty's IRA Advisor

"A book every investor should have on his desk--avery valuable guide to minimizing tax on all kinds ofinvestments, from retirement plans to college savings to swapcontracts."

--Martin Edelston

Publisher, Bottom Line/Personal

--Robert H. Stovall, CFA

Senior Vice President and Market Strategist, PrudentialFinancial

"Understanding the growing range of tax-efficientinvesting alternatives is no longer anoption--it's a critical element of soundfinancial planning. This book is an essential tool for graspingand maximizing today's rapidly expanding menu of innovativeinvestment choices."

--Peter Quick

President, American Stock Exchange

"If you hate taxes, you'll love this book!Authors Robert Gordon and Jan Rosen reveal a catalogue oftax-cutting strategies for taxpayers and investors."

--Ed Slott, CPA

Editor, Ed Slotty's IRA Advisor

"A book every investor should have on his desk--avery valuable guide to minimizing tax on all kinds ofinvestments, from retirement plans to college savings to swapcontracts."

--Martin Edelston

Publisher, Bottom Line/Personal

Für dieses Produkt wurde noch keine Bewertung abgegeben. Wir würden uns sehr freuen, wenn du die erste Bewertung schreibst!

Eine Bewertung schreiben

Eine Bewertung schreiben

Andere Kunden interessierten sich für